Understanding the Landscape for Raising Pre-Seed Funding

Strategic Timing for Pre-Seed Funding with a Visual Timeline

In the context of raising pre-seed funding, understanding the landscape is critical. This involves a thorough analysis of market dynamics, investor trends, and the startup ecosystem. Let's expand on this with more specificity and ideas:

Market Dynamics

- Industry-Specific Trends:

- Analyze the growth patterns and investment activities in your specific industry. For tech startups, for instance, look into the emerging technologies attracting investment.

- Understand the customer demand within your industry. Are there emerging needs or gaps that your startup is addressing?

- Economic Factors:

- Consider macroeconomic factors like the state of the economy, interest rates, and investment trends. For example, during an economic downturn, investors might be more risk-averse.

- Look into government policies and regulations that could impact your industry and funding opportunities.

Investor Trends

- Investment Preferences:

- Research the current preferences and focuses of investors. Are they leaning towards early-stage investments, or are they more interested in growth-stage companies?

- Understand the sectors that are attracting the most funding. For example, healthcare and technology might be hot sectors at a given time.

- Investor Behavior in Pre-Seed Stages:

- Investigate how investors evaluate pre-seed startups. What metrics or milestones are they looking at?

- Look into the typical investment sizes and terms for pre-seed funding.

Start-up Ecosystem

- Competitive Analysis:

- Conduct a competitive analysis to understand how your startup stands in comparison to others seeking funding. What differentiates your startup?

- Identify the key players and emerging startups in your industry.

- Networking and Ecosystem Support:

- Assess the availability of incubators, accelerators, and mentorship programs that could support your journey.

- Networking events and startup meetups can provide insights into the ecosystem's dynamics and opportunities for collaboration.

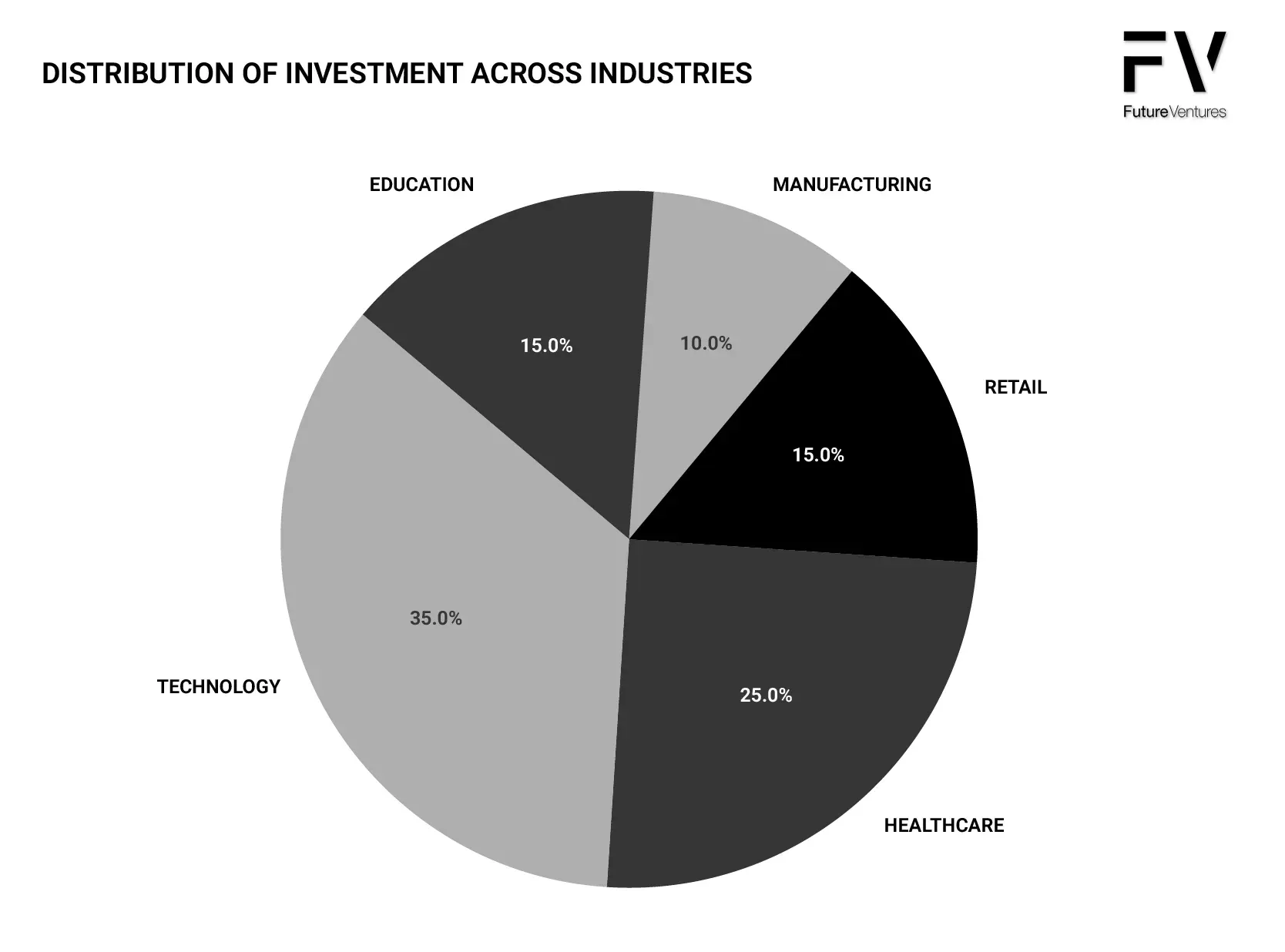

Distribution of Investment Across Industries

Understanding the market trends and which industries are attracting more investor attention, allows founders to position their pitch and strategy accordingly. For a startup seeking pre-seed funding, aligning with these trends can be a strategic move to increase the likelihood of successful funding. Typically, good ideas, in a growing market, pursued by founders with grit and chip (on their shoulder) get funded, regardless of what's hot in a given year. The question then becomes at what valuation and what terms.

Final Thoughts

Overall, understanding the investment landscape with the aid of such data-driven visualizations is crucial. It provides startups with a clearer picture of where they stand and what to expect as they navigate the complex journey of securing pre-seed funding.

References

New Paragraph