Comprehensive Guide to Search Funds

I. Introduction

Definition of a Search Fund

What is a search fund? A Search Fund is an investment vehicle that enables entrepreneurs to acquire and operate a small to medium-sized business with support from external investors. Unlike traditional startups, where founders build a company from scratch, the search fund model raises capital specifically to purchase existing companies. The model appeals to recent MBA graduates and young professionals who want to become CEOs earlier in their careers. These entrepreneurs, called “searchers,” use the financial and advisory support of investors to identify, acquire, and scale a target business over several years, aiming to create value and achieve a profitable exit. Search funds give inexperienced entrepreneurs a quick path to managing a company with meaningful ownership.

Historical Overview of Search Funds

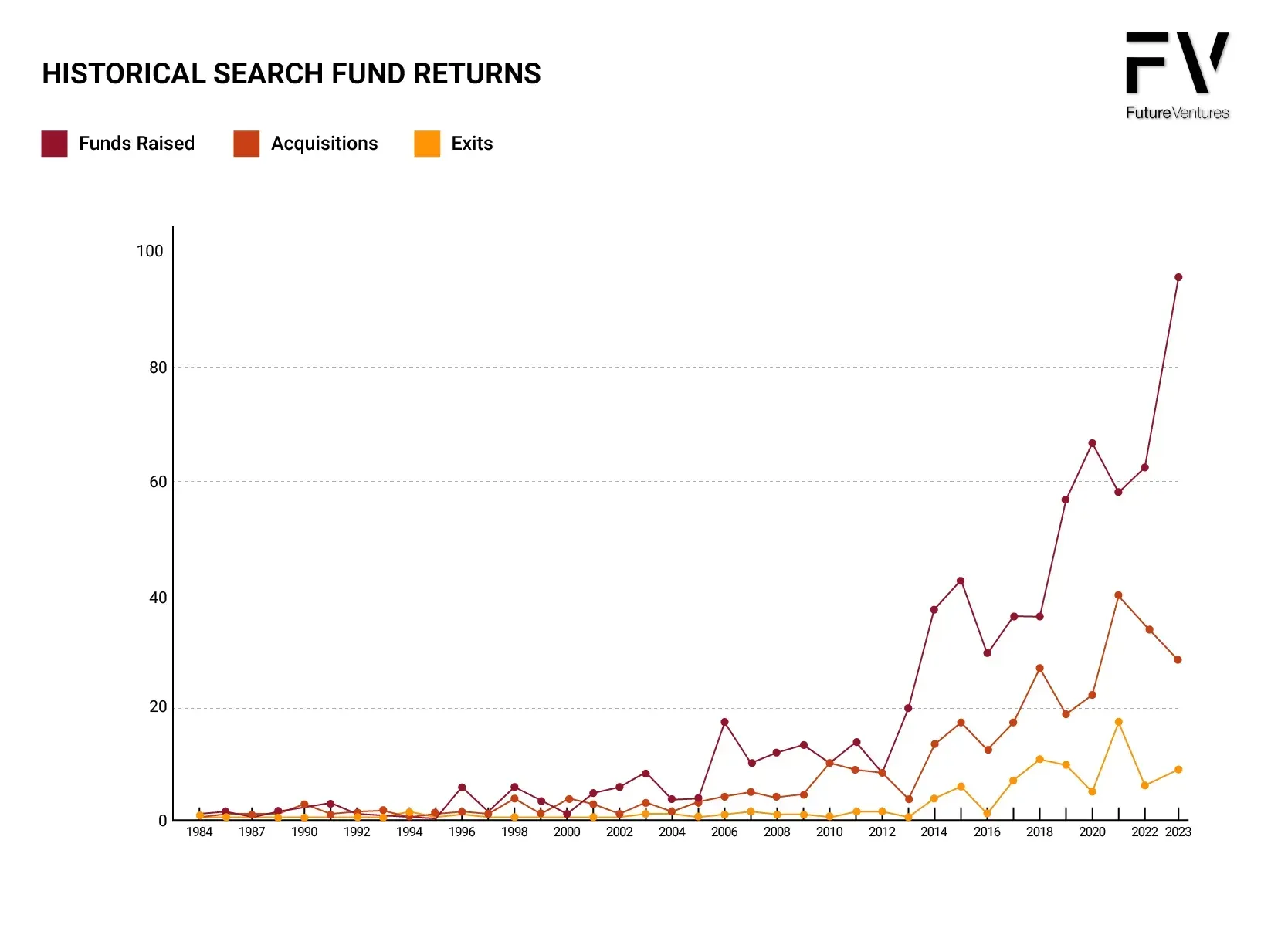

The concept of search funds was pioneered in 1984 by H. Irving Grousbeck at Stanford University’s Graduate School of Business. Initially, search funds were a niche model predominantly in the United States. The emergence and growth of international search funds have been notable, with studies illustrating their rising number and global expansion. The performance and characteristics of international funds have been analyzed and tracked by academic institutions, highlighting their returns compared to North American funds. Over the decades, the model gained traction, particularly in North America, where search funds started as an alternative path to entrepreneurship. By the early 2000s, search funds began to expand globally, with increasing interest in Europe, Latin America, and, more recently, Asia. Today, search funds are recognized as a viable means for aspiring entrepreneurs to acquire and operate established businesses while providing investors with unique opportunities for potentially high returns. The International Search Fund Center established by IESE plays a crucial role in supporting international searchers and conducting in-depth analysis of search funds across different global regions.

Importance of Search Funds in the Entrepreneurial Ecosystem

Search funds occupy a unique position in the entrepreneurial landscape, bridging the gap between traditional startups and private equity. Unlike startups, which involve creating new products or services, search funds acquire existing businesses with proven market demand. This reduces some of the risks associated with startups. Search funds also offer a more accessible path for talented individuals to gain ownership and operational experience without needing substantial personal capital. For investors, most search funds provide access to the small and medium-sized enterprise market, which traditional private equity and venture capital firms often overlook.

II. The Search Fund Model

Key Components of a Search Fund

The search fund model consists of several key components, each playing a vital role in the success of the overall process:

- Searcher(s): The entrepreneur(s) leading the search fund effort, responsible for finding, acquiring, and managing a target business. Typically, searchers are individuals with a strong educational background, often recent MBA graduates, with aspirations of becoming CEOs.

- Investors: A group of experienced entrepreneurs, investment professionals, or family offices who provide the initial capital and mentorship required to fund the search and acquisition phases.

- Target Company: The business identified for acquisition is typically characterized by stable cash flows, a proven track record, and significant growth potential.

According to the 2024 Stanford Search Fund Study, 57% of searchers successfully acquired a company, indicating that while there is a reasonable chance of success, it is not guaranteed. These companies are often located in urban areas and employ strategic management approaches post-acquisition.

The Search Phase

The search phase is the initial stage of the search fund process, during which the entrepreneur seeks a suitable business to acquire.

- Duration: This phase typically lasts between 18-24 months.

- Activities:

- Raising Initial Capital: The searcher raises a small amount of capital from investors to cover search expenses, such as salaries, travel, and due diligence costs.

- Identifying Potential Acquisition Targets: The searcher actively searches for businesses that meet specific financial and strategic criteria. This involves market research, networking, and outreach to business brokers, owners, and intermediaries.

- Conducting Preliminary Due Diligence: The searcher evaluates the financial health, competitive position, and growth potential of identified targets to narrow down the list of viable acquisition candidates.

The Acquisition Phase

Once a suitable target is identified, the search fund enters the acquisition phase.

- Duration: This phase typically lasts 3-6 months.

- Activities:

- Negotiating with the Seller: The searcher negotiates the purchase terms, including price, financing, and any contingencies.

- Conducting Thorough Due Diligence: A comprehensive due diligence process is conducted to verify the accuracy of financial statements, assess operational risks, and identify potential liabilities.

- Securing Acquisition Capital: Once a suitable company is identified, the searcher raises additional capital to fund the purchase, typically combining equity from investors with debt.

- Closing the Deal: The final legal and financial arrangements are completed, and the search fund officially acquires the business. The search fund model faces inherent risks during the acquisition phase, including high valuations and fierce competition.

The Build Phase

After acquiring the target company, the search fund enters the build phase, where the searcher focuses on growing and optimizing the business.

- Duration: This phase typically spans 5-7 years.

- Activities:

- Operating and Growing the Acquired Business: The searcher assumes the role of CEO or a similar leadership position and focuses on running the business effectively.

- Implementing Value Creation Strategies: This may involve streamlining operations, expanding product lines, enhancing marketing efforts, or entering new markets.

- Preparing for Eventual Exit: The searcher develops and executes an exit strategy to maximize returns, whether through a sale, merger, or recapitalization.

III. Advantages of Search Funds

- Alignment of Interests Between Investors and Entrepreneurs: The search fund model is structured to align the interests of both the searcher and the investors. Both parties are motivated to maximize the value of the acquired business, as the searcher’s equity stake in the company provides a strong financial incentive to drive growth and profitability.

- Access to Capital and Expertise: Searchers benefit not only from the financial capital provided by investors but also from their mentorship and advisory support. A third of all successful search funds in the past decade credited their success to effective mentorship. This access to a network of seasoned entrepreneurs and investment professionals can be invaluable in navigating the complexities of acquiring and operating a business.

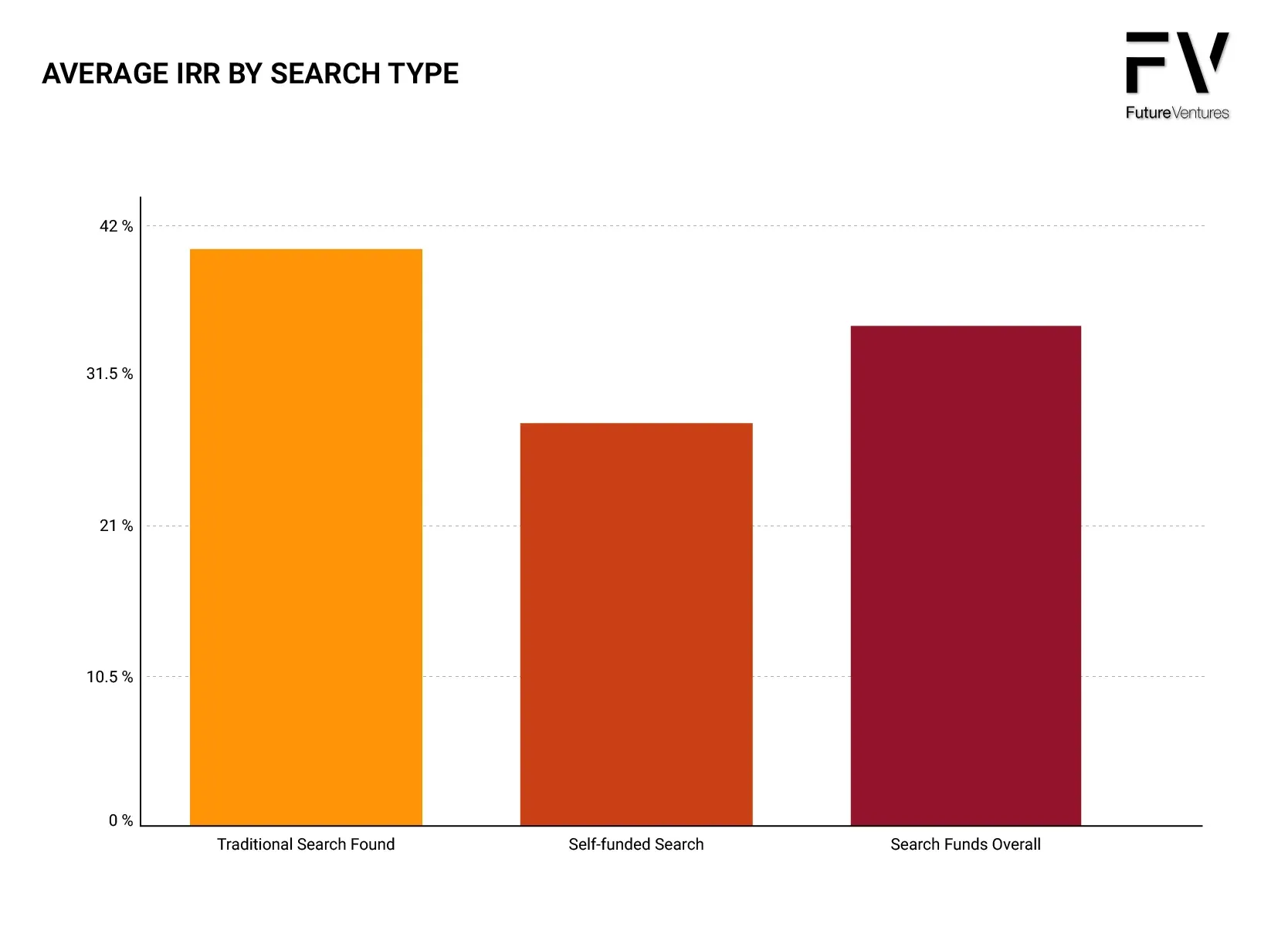

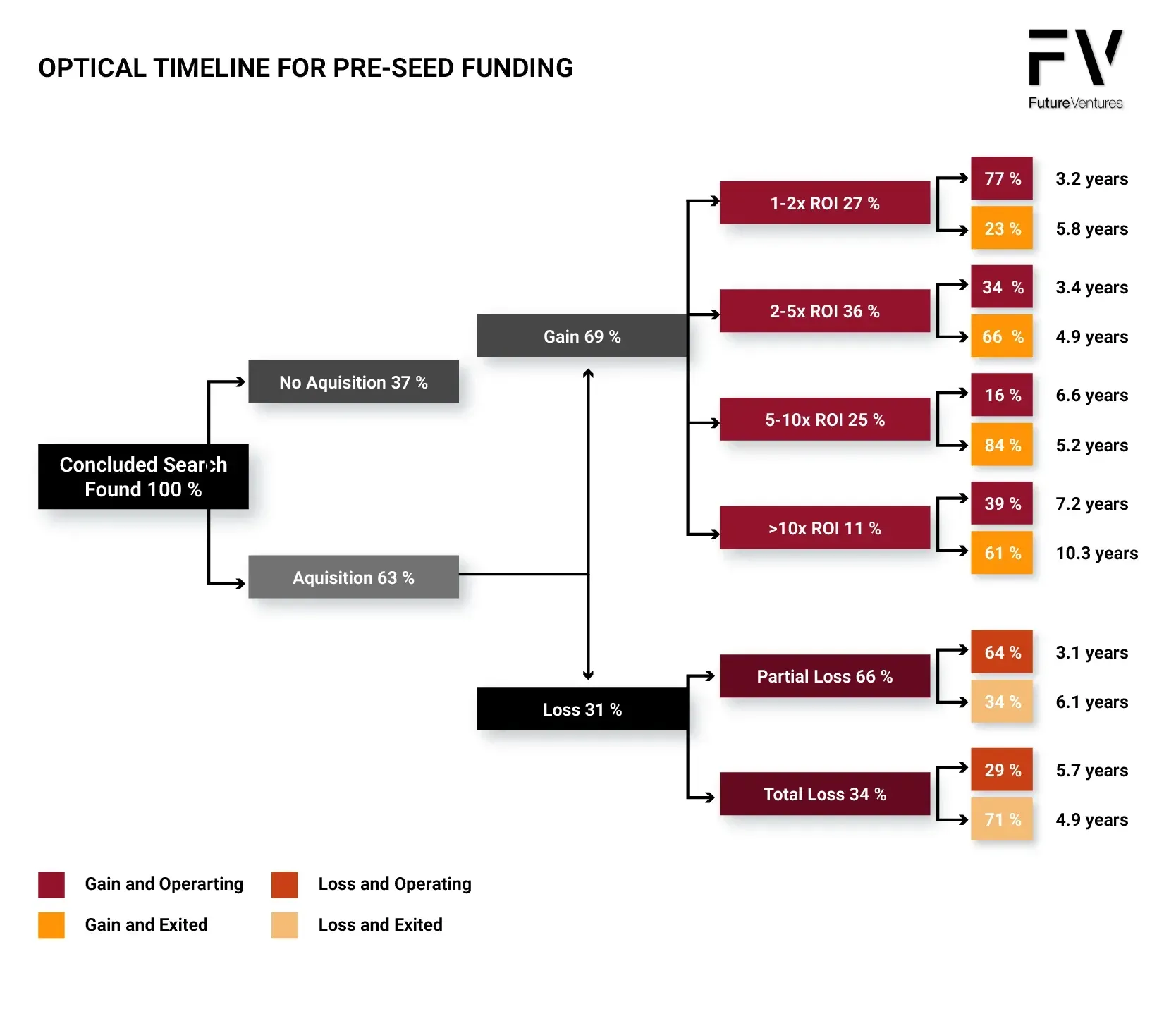

- Potential for High Returns: Historically, search funds have delivered attractive returns to investors, often outperforming traditional private equity investments. The most successful search funds thrive on their flexibility and focus on established businesses, contrasting their investment strategies with those of venture capital firms. Successful search funds have generated returns of 2.5-3x invested capital, with top-performing funds achieving returns of 10x or more. The 2024 Stanford Search Fund Study reports an aggregate pre-tax IRR of 35.1% and an ROI of 4.5x for all search funds. Historical search fund returns are used to estimate beta, indicating higher returns and lower systemic exposure than the market. Additionally, the aggregate pre-tax internal rate of return for search funds was 35.3%.

- Flexibility in Investment Strategy: Search funds are not restricted to specific industries or geographies. This flexibility allows searchers to tailor their search to areas where they have expertise or where they see the most promising opportunities. This adaptability can lead to a more customized investment approach, potentially increasing the chances of success.

IV. Challenges and Risks Associated with Search Funds

- Finding the Right Target Company: Identifying a suitable acquisition target is often one of the most challenging aspects of a search fund. The searcher must find a business that meets both financial criteria, such as stable cash flow and reasonable valuation, and strategic criteria, such as growth potential and market positioning. This process can be time-consuming and may require evaluating hundreds of potential targets. Additionally, search fund entrepreneurs often face challenges like unrealistic expectations in finding the perfect acquisition target, which can further complicate the search process. Approximately 43% of search funds fail to acquire a company despite dedicated searching.

- Due Diligence Process: Conducting thorough due diligence is critical to successful search fund investing and acquisitions but can be complex, especially for first-time entrepreneurs. Due diligence involves analyzing financial records, assessing legal and regulatory compliance, evaluating operational processes, and understanding potential risks. Any oversight or mistake during this process can lead to significant financial losses. Search funds often fail due to inadequate due diligence and poor post-acquisition management.

- Integration Challenges: Post-acquisition, the searcher must integrate into the new business, often taking over as CEO or another key executive role. This transition can be challenging, especially if existing management or staff resist it. Successful integration requires strong leadership, clear communication, and an ability to manage change effectively.

- Exit Strategies: A well-defined exit strategy is crucial for realizing returns on investment. However, developing and executing a successful exit strategy can be challenging, particularly in uncertain market conditions. Searchers must carefully plan the timing and method of exit, whether through a sale, merger, or recapitalization, to maximize returns.

V. The Future of Search Funds

Emerging Trends and Innovations

The search fund model continues to evolve with emerging trends and innovations, such as:

- Increased Focus on Technology-Enabled Businesses: As technology transforms industries, search funds are increasingly targeting businesses with strong technological components or digital transformation potential.

- Rise of Self-Funded Searches: Some searchers choose to self-fund their searches using personal savings or loans rather than relying on external investors. This approach, known as self-funded search funds, can provide greater autonomy but may also involve higher personal risk.

- Growing Interest in International Markets: Search funds are expanding beyond North America, with increased activity in Europe, Latin America, and Asia. This geographic diversification provides new opportunities but also presents unique challenges in terms of market dynamics, regulations, and cultural differences.

- Search Fund Accelerators: The concept of search fund accelerators has emerged to provide structured support and mentorship for aspiring entrepreneurs. The emergence of search fund incubators may help mitigate high failure rates by offering technical support to search funds.

Geographic Expansion of Search Funds

Search funds are gaining traction in regions outside the United States. The evolution and advantages of the search fund industry position it as a viable alternative to traditional startup pathways, offering the potential for wealth creation and lower risks through multiple acquisitions. Europe, Latin America, and Asia have seen a rise in search fund activity, driven by a growing number of entrepreneurial MBA graduates and a developing ecosystem of investors interested in the model.

Studies have shown that search funds in the United States and Canada have historically provided strong returns, contrasting with the performance metrics of international funds. According to the 2024 International Search Fund Study by IESE Business School, international search funds have delivered an overall ROI of 2.0x and an IRR of 18.1%, which are lower than the U.S. and Canada averages but still demonstrate positive returns.

Each region presents unique opportunities and challenges, such as differences in market size, regulatory environment, and cultural preferences. According to a 2016 IGF report, international search funds have different characteristics, favoring acquisitions in business services, IT, health care, and education.

Impact of Technology on Search Funds

Technology is transforming how searchers identify and evaluate potential acquisition targets. Tools like artificial intelligence, big data analytics, and advanced software platforms enable searchers to analyze market trends, assess competitive positioning, and streamline due diligence processes more efficiently. Additionally, technology plays a crucial role in optimizing operations and driving growth in acquired businesses.

Potential Regulatory Changes

As search funds become more prevalent, they may face increased regulatory scrutiny. Potential changes in legal frameworks governing these investments could impact how search funds are structured, financed, and operated. Searchers and investors need to stay informed about regulatory developments and adapt their strategies accordingly.

VI. Characteristics of Successful Search Fund Entrepreneurs

Searcher Profile

Successful search fund entrepreneurs typically possess a combination of skills and qualities that enable them to navigate the complexities of acquiring and managing a business:

- Strong Leadership and Management Skills: It is critical to be able to inspire and lead a team, make strategic decisions, and manage day-to-day operations.

- Financial Acumen: A solid understanding of financial statements, valuation, and financial modelling is essential for assessing potential acquisitions and managing a business.

- Adaptability and Resilience: The entrepreneurial journey can be unpredictable and challenging. Successful searchers must be adaptable and resilient in the face of setbacks or unexpected developments.

- Industry Expertise or Ability to Quickly Learn a New Industry: While deep industry expertise can be an advantage, many successful searchers are generalists who can quickly learn and adapt to new industries.

- Excellent Communication and Negotiation Skills: Building relationships with investors, sellers, employees, and customers requires strong communication and negotiation skills.

VII. Investment Strategy and Risks

Investment Approach

The investment strategy of a search fund typically focuses on acquiring profitable, stable businesses with growth potential. Search fund investments offer exposure to a diverse set of opportunities with the potential for high returns and reduced risks.

- Target Companies: Businesses valued between $5 and 50 million are often ideal targets, as they are too small for most private equity firms but large enough to offer significant growth opportunities.

- Industry Focus: Industries with fragmented markets and opportunities for consolidation are often attractive. Examples include healthcare, business services, technology, and niche manufacturing.

Mitigating Risks

To mitigate risks, search fund investors and searchers often employ several strategies:

- Diversification Across Multiple Search Funds: Investors often diversify their investments across multiple search funds to reduce risk.

- Thorough Due Diligence Process: Rigorous due diligence helps identify potential risks and ensure that the target business meets the necessary criteria.

- Active Involvement of Experienced Investors: Experienced investors can provide valuable guidance and support throughout the search and acquisition process.

- Structured Incentives for the Searcher: Aligning the searcher’s incentives with those of the investors ensures that both parties are committed to maximizing value.

VIII. Economic Outcomes and Value Creation

Expected Returns

Historically, search funds have offered compelling returns to investors. Data indicates that the median return on invested capital for search funds is approximately 2.5-3x, with some top-performing search funds growing and achieving returns of 10x or more. These returns are often achieved over 5-7 years, making search funds a potentially attractive investment compared to traditional private equity. The aggregate pre-tax return on invested capital for search funds was 5.2x.

Creating Value in Acquired Businesses

Value creation in search funds often involves a combination of operational improvements, strategic growth initiatives, and leveraging technology:

- Implementing Operational Improvements: Streamlining operations, reducing costs, and improving efficiency can enhance profitability.

- Pursuing Strategic Growth Initiatives: Expanding into new markets, launching new products, or acquiring complementary businesses can drive growth.

- Leveraging Technology and Best Practices: Adopting modern technology and best practices can improve operational performance and competitiveness.

- Expanding into New Markets or Product Lines: Diversifying the business’s offerings can create additional revenue streams and reduce dependency on a single market or product.

Historical Search Fund Returns:

Search funds have historically delivered strong returns, making them an attractive investment vehicle. According to the 2024 Stanford Search Fund Study, the average internal rate of return (IRR) across all search funds is 35.1%, with a return on investment (ROI) of 4.5x.

Exited search funds performed even better, achieving an IRR of 42.9%. While these returns are impressive, they reflect a wide distribution: 11% of companies achieved over 10x ROI, but 31% resulted in losses.

Compared to traditional asset classes like private equity and venture capital, search funds offer superior risk-adjusted returns due to their strategic focus on acquiring and improving small businesses. However, success depends heavily on rigorous due diligence and operational execution.

IX. Is a Search Fund Right for You?

Self-Assessment and Next Steps

If you are considering a search fund as a path to entrepreneurship, it is essential to evaluate your skills, experience, and personal goals:

- Evaluate Your Skills and Experience: Assess whether you have the necessary skills, such as leadership, financial acumen, and adaptability, to succeed as a search fund entrepreneur.

- Research and Network with Current and Former Searchers: Speak with individuals who have experience in search funds to gain insights and understand the challenges and opportunities.

- Consider Attending Search Fund Conferences or Educational Programs: These events can provide valuable networking opportunities and knowledge.

- Assess Your Risk Tolerance and Financial Situation: Determine whether you are comfortable with the risks involved, including the potential loss of your initial investment.

X. Case Studies

Successful Search Fund Examples

- Case Study 1: Acquired by a search fund in 2015, Company A was a niche manufacturing business with stable cash flows and a strong market position. The searcher implemented several operational improvements, expanded the product line, and grew the company’s market share, resulting in a successful exit in 2022 with a return of 5x invested capital.

- Case Study 2: A business services firm, was acquired by a search fund in 2017. The searcher focused on digital transformation and expanding into new markets. By 2023, the company had doubled its revenue, leading to a successful exit and a return of 8x invested capital.

Lessons Learned from Failures

- Case Study 3: A search fund acquired Company C in 2018, a retail business with declining revenues. Despite efforts to revitalize the company, the searcher faced challenges with integration, market shifts, and unforeseen regulatory changes. The business was eventually sold at a loss, underscoring the importance of thorough due diligence and risk management.

Comparative Analysis of Different Search Fund Models

- Traditional Search Funds vs. Self-Funded Searches: Traditional search funds involve raising capital from external investors, while self-funded searches rely on the searcher’s personal resources. The search fund model was created at Stanford Business School in 1984, providing an alternative path for aspiring entrepreneurs. While self-funded searches offer greater autonomy, they also involve higher personal financial risk. Studies and data published by the Stanford Graduate School of Business highlight the performance and success rates of these models. The Stanford Search Fund Study emphasizes the impressive performance metrics of search funds, including high average annual returns and multiples on invested capital.

- Search Fund Accelerators: These are programs that provide funding, mentorship, and resources to searchers in exchange for equity. They offer a middle ground between traditional and self-funded searches, combining external capital with structured support.

XI. Conclusion

Summary of Key Points

Search funds offer a unique path to entrepreneurship through acquisition, enabling aspiring entrepreneurs to become business owners and operators with the backing of experienced investors. The model offers the potential for high returns but comes with significant challenges, such as finding the right target, conducting due diligence, raising acquisition capital and managing the acquired business effectively.

Future Outlook for Search Funds

The search fund model is likely to continue growing and evolving, driven by increased interest from entrepreneurs and investors. As the model gains popularity, competition may increase, leading to innovations in deal structures and target selection. Additionally, international expansion will likely continue, with search funds adapting to local market conditions and regulations.

Encouragement for Potential Search Fund Investors and Entrepreneurs

For aspiring entrepreneurs, search funds offer a compelling path to business ownership and leadership. For investors, search funds provide access to a unique asset class with the potential for attractive returns. Success in the search fund model requires thorough research, careful planning, and a strong network of support from experienced investors and advisors. With the right approach, both searchers and investors can achieve significant value creation and financial success.