Venture Studios vs. Accelerators: Which Path Is Right for Your Startup?

The differences between both venture studios and accelerators represent more than just a semantic distinction—they embody fundamentally different philosophical approaches to startup creation and growth. With venture studios showing 30% higher success rates than traditional startups and offering comprehensive resources beyond just financial resources and accelerators providing proven scaling frameworks, choosing the right path could be the most consequential decision you make for your entrepreneurial journey. This comprehensive guide dissects both models, offering an incisive analysis of which option aligns best with your vision, resources, and growth trajectory.

Understanding the Options in Accelerator Programs

The startup ecosystem has evolved beyond the traditional bootstrap-or-VC-funding binary. Today’s entrepreneurs face a more nuanced landscape where specialized support structures can dramatically alter a startup’s trajectory. Let’s dissect these options to understand their fundamental philosophies.

Different support systems, such as incubators, accelerators, and venture studios, play a crucial role in shaping the startup journey by providing comprehensive guidance tailored to various stages, enhancing innovation, collaboration, and long-term success.

What is a Startup Accelerator?

Startup accelerators function as high-intensity boot camps for existing startups with some market validation. Think of them as the CrossFit of startup development: focused, intense, and designed to produce rapid results in a condensed timeframe. Accelerators help early-stage startups scale and quickly get their product to market.

Accelerators operate on a fixed timeline (typically 3-6 months) with structured programming aimed at rapidly scaling businesses that already have a minimum viable product (MVP). They seek startups with a solid business model ready for rapid growth, providing seed funding (usually in exchange for 5-15% equity), mentorship from industry veterans, and networking opportunities that culminate in a “demo day” pitch event to potential investors.

Additionally, accelerators typically offer mentorship, networking, and initial funding, often in exchange for smaller equity stakes, compared to venture studios.

Y Combinator, Techstars, and 500 Startups have perfected this model, focusing on speed and scale rather than ideation and fundamental business building. The accelerator approach works well for founders who already have a solid concept and MVP but need resources, connections, and strategic guidance to scale quickly.

Despite not having an active accelerator program in Canada at the moment, Techstars is the largest eary stage investor in Canada, with a portfolio of 265 companies.

If you reside in Alberta, please consult our comprehensive guide on Accelerator programs. All of the accelerators in Alberta are non-equity as government programs fund them.

What is a Venture Studio?

Venture builders, also known as venture studios, startup studios, or company builders, represent a fundamentally different approach. Rather than accelerating existing startups, they build companies from scratch, often generating the ideas internally before recruiting entrepreneurial talent to lead them. Venture studios create startups from the ground up, often in quick succession, leveraging their structured processes and resources to maximize efficiency and success.

Venture studios provide comprehensive operational support, including product development, marketing expertise, legal services, and HR, while taking a much larger equity stake (typically 20-40% or higher). Their involvement is deeper and longer-term, with flexible timelines that can extend for years rather than months. The development process of venture studios is more intensive than that of accelerators, as they focus on building startups from the ground up with a structured and hands-on approach.

Notable examples include Idealab (which has created over 100 companies), Hexa (pka eFounders), and High Alpha. These studios effectively function as startup factories, using shared resources and proven methodologies to systematically build multiple companies simultaneously. A significant amount of planning and research goes into the selection process of startups in venture studios, ensuring that only the most promising ideas are pursued.

What is Not a Venture Studio?

A venture builder is

not a dev shop that trades code for equity. Service-for-equity models essentially act as outsourced product teams, building what a founder requests without owning the vision, generating ideas, or managing the company. A true venture studio conceives, builds, and operates ventures itself, taking founder-level responsibility. Not just swapping development hours for a slice of someone else’s startup.

Key Differences: Accelerator vs. Venture Studio

The distinction between these models goes far beyond superficial differences—it reflects fundamentally different approaches to company creation and development. The venture studio model provides a comprehensive and collaborative ecosystem that supports startups through a multifaceted approach.

Focus and Philosophy

Accelerators operate on the premise that entrepreneurial talent with good ideas needs catalytic support to achieve rapid growth. Their focus is on acceleration, not creation. The underlying belief is that market-ready startups simply need a boost to reach escape velocity. Different programs cater to varying needs based on the startup stage, whether a startup is in the idea stage, has a validated business model, or is facing specific challenges that require specialized support.

Venture studios, conversely, operate on the principle that systematic company building with professional resources produces better outcomes than traditional entrepreneurship. They bring the efficiency of an assembly line to the chaotic process of startup creation. Venture studios focus all their resources on developing a few highly promising startups, ensuring a concentrated and effective use of their expertise and capital. They are particularly well-suited for startups entering a space with few competitors, where their structured approach can provide a significant advantage.

Equity Structure and Investment Model

The equity exchange reflects these philosophical differences. Accelerators typically take 5-15% equity for providing mentorship and seed funding (usually $50K-$150K), while venture studios claim 20-40% or more in exchange for their deeper involvement and larger initial investments ($500K-$2M+). Venture studios often retain less ownership of startups compared to incubators, which are typically funded by non-profit or academic organizations and may not require equity stakes at all.

Venture capital firms play a crucial role in funding startup incubators and company builders, providing capital in exchange for equity to support the development of early-stage companies.

Operational Support and Resources

The difference in day-to-day support is striking. Accelerators provide mentorship, networking, and educational programming but expect the startup team to execute. Venture studios roll up their sleeves and get directly involved in operations, often providing shared services across their portfolio companies.

Additionally, these programs often provide free or affordable office space for startups, helping to save time and money as they work to launch and scale their businesses.

Timeline and Commitment

Accelerators operate on fixed, short-term timelines (typically 3-6 months), whereas venture studios maintain flexible, long-term involvement that can extend for years. This reflects their different goals: accelerators aim to prepare startups for the next funding round, while venture studios build companies for sustainable long-term success. Venture studios excel in launching startups by rapidly developing multiple startups simultaneously through dedicated resources and expertise.

Target Start-ups and Stage

Accelerators select existing startups with MVPs and clear business plans, while venture studios often develop ideas internally or work with entrepreneurs at the conceptual stage. Accelerators help you grow what you’ve built; venture studios help you build from scratch.

Startup incubators, on the other hand, play a crucial role in supporting early-stage startups by providing valuable resources such as mentorship, workspace, and networking opportunities. Many incubators allow applications with just a promising idea or outline of a business plan, making them accessible to entrepreneurs at the very beginning of their journey. Incubators are often funded by non-profit groups, academic institutions, or government organizations, which allows them to focus on nurturing innovation and supporting entrepreneurs without the same profit-driven motives as other models.

Benefits and Considerations

Each model offers distinctive advantages that suit different types of founders and business concepts. Understanding these benefits is crucial for making an informed decision. Additionally, joining a startup incubator can provide essential resources, mentorship, and community support to entrepreneurs in the early stages of their business journey.

Benefits of Joining a Startup Accelerator

Accelerators offer a sprint-like approach to growth that can dramatically compress your startup’s development timeline. Their benefits include:

- Speed to market: The intensive 3-6 month programs force rapid progress and decision-making that might otherwise take years.

- Network effects: Access to alumni networks, investor connections, and industry partners creates opportunities that would be difficult to access independently.

- Social proof and validation: Association with prestigious accelerators provides credibility that helps with subsequent fundraising and customer acquisition.

- Structured learning: Curriculum-based programming provides frameworks and methodologies for addressing common startup challenges.

- Peer learning: Being part of a cohort allows founders to learn from others facing similar challenges, creating valuable knowledge exchange and support systems.

While accelerators primarily aim to scale existing businesses, incubator programs focus on nurturing early ideas and achieving product-market fit.

Benefits of Joining a Venture Studio

Venture studios offer a more comprehensive approach to company building that minimizes many early-stage risks. Their advantages include:

- Reduced startup risk: The studio’s proven methodologies and resources address many common reasons for startup failure, resulting in significantly higher success rates (30% higher than traditional startups).

- Accelerated funding journey: Studio-backed startups reach seed funding in 10.7 months (versus 36 months for traditional startups) and Series A in 25.2 months (versus 56 months).

- Access to specialized expertise: In-house teams provide professional-grade expertise in product development, marketing, finance, and operations that early-stage startups typically cannot afford.

- Shared resources: Common back-office functions, technology infrastructure, and operational frameworks create economies of scale across portfolio companies.

- Higher IRR: Venture studio startups demonstrate an average internal rate of return of 53% compared to 21.3% for traditional startups.

Venture studios provide comprehensive guidance tailored to various stages of the startup journey, enhancing innovation, collaboration, and long-term success.

Drawbacks of Accelerators and Venture Studios

While accelerators and venture studios can be valuable resources for startups, they also have their drawbacks. Here are some of the potential downsides to consider:

Accelerators:

- High competition: With numerous startups vying for limited spots, getting accepted into a prestigious accelerator program can be incredibly challenging. The acceptance rate in Techstars and YC is below 3%.

- Limited focus: Many accelerators specialize in specific industries or sectors, which can exclude startups that don’t fit their niche.

- Time constraints: The fixed duration of accelerator programs (typically 3-6 months) can be a double-edged sword, pushing startups to rush their development process.

- Equity stakes: In exchange for their support, accelerators often take a significant equity stake (5-15%), which can be a concern for founders who want to maintain control.

- Pressure to scale: The intense focus on rapid growth can be stressful for startups that may not be ready to scale at such a fast pace.

Venture Studios:

- Loss of control: Venture studios often take a larger equity stake (20-40% or higher), which can result in a loss of control for the startup founders.

- Dependence on the studio: Startups that rely heavily on the venture studio’s resources and expertise may struggle to operate independently once they leave the studio environment.

- Limited flexibility: The structured approach of venture studios can sometimes limit the flexibility and creativity of the startup founders.

- High expectations: Venture studios often have high expectations for the startups they support, which can be stressful for founders who are not yet ready to meet those expectations.

- Potential for conflict: With significant equity stakes, venture studios may have conflicting interests with the startup founders, particularly when it comes to strategic decisions.

Due Diligence and Evaluation

Selecting the right accelerator or venture studio requires thorough due diligence. Here’s how to evaluate your options effectively. It is crucial to have a well-established business model to attract the right accelerator or venture studio.

What to Consider When Evaluating a Startup Accelerator

When assessing accelerators, focus on these key criteria:

- Track record: Examine the performance metrics of past cohorts, including fundraising success, valuation growth, and survival rates.

- Mentor quality: Research the backgrounds and involvement levels of the mentors, as they’ll be your primary source of guidance and connections.

- Program specificity: Consider whether the accelerator specializes in your industry or has relevant experience with similar business models.

- Post-program support: Evaluate what happens after demo day—do they offer ongoing support, follow-on funding, or alumni resources?

- Equity requirements: Assess whether the equity stake they require aligns with the value they provide in funding, connections, and growth potential.

Additionally, understanding your position in the startup stage is crucial, as different programs cater to varying needs based on whether a startup is in the idea stage, has a validated business model, or is facing specific challenges that require specialized support.

What to Consider When Evaluating a Venture Studio

For venture studios, different evaluation criteria apply:

- Portfolio performance: Review their existing companies’ performance, including time to market, funding success, and exits.

- Domain expertise: Assess whether the studio has specific knowledge and connections in your industry vertical.

- Operational capabilities: Evaluate the depth and quality of their in-house teams that will support your company’s development.

- Equity structure: Understand not just the percentage but the vesting schedule, co-founder equity allocation, and future funding implications.

- Decision-making autonomy: Clarify your level of autonomy as CEO and how strategic decisions will be made between you and the studio.

The venture studio model provides a comprehensive and collaborative ecosystem that supports startups through funding, essential resources, mentorship, and strategic guidance, promoting a more holistic growth experience compared to traditional accelerators or incubators. Venture studios integrate experienced leaders into startup teams, often in crucial roles, to ensure that the startups benefit from seasoned expertise right from the start.

Evaluating Your Startup’s Needs

When deciding between an accelerator and a venture studio, it’s essential to evaluate your startup’s specific needs. Here are some factors to consider:

- Stage of development: If your startup is still in the early stages of development, a venture studio may be a better fit. Venture studios build startups from scratch, providing comprehensive support. If your startup is more established and has a minimum viable product (MVP), an accelerator may be more suitable.

- Industry and sector: Look for accelerators or venture studios that have expertise in your specific industry or sector. This specialized knowledge can be invaluable in navigating industry-specific challenges.

- Funding needs: If your startup requires significant funding, a venture studio may be a better option due to their larger initial investments. If your startup needs smaller amounts of funding to reach the next milestone, an accelerator may be more suitable.

- Mentorship and support: Consider the level of guidance and support your startup needs. Accelerators offer structured mentorship programs and access to industry experts, while venture studios provide deep bench strength of resources.

- Equity stakes: If maintaining control of your startup is a priority, look for accelerators or venture studios that offer more flexible equity arrangements. Understand the equity structure and how it aligns with the value provided.

Choosing the Right Path

Choosing between an accelerator and a venture studio hinges on your startup's specific needs, strengths, and goals. Startup incubators also play a vital role by providing early-stage startups with essential resources like mentorship, workspace, and networking opportunities. They help founders refine their ideas, achieve product-market fit, and prepare for investment opportunities.

Is a Startup Accelerator Right for You?

Consider an accelerator if:

- You already have a MVP and initial traction

- You need to quickly scale and reach the next funding milestone

- You have a complete founding team with complementary skills

- You value maintaining higher equity ownership

- You benefit from structured programming and deadlines

- You’re seeking a broad network across multiple industries

Accelerators work best for founders who already have momentum but need a catalyst to reach the next level. They’re ideal if you have a clear vision and execution capability but require resources and connections to scale faster. Unlike incubator programs, which focus on nurturing early ideas and achieving product-market fit, accelerators primarily aim to scale existing businesses.

Is a Venture Studio Right for You?

Consider a venture studio if:

- You have an idea but limited technical or operational experience

- You’re willing to exchange more equity for comprehensive support

- You value systematic approaches to company building

- You prefer gradual, sustainable growth over rapid scaling

- You want deep operational support beyond just advice

- You’re entering a complex industry with high barriers to entry

Venture studios shine when building companies requires specialized expertise, significant upfront resources, or complex operational capabilities. They’re particularly valuable for first-time entrepreneurs or those entering technically challenging markets. Venture builders, also known as company builders or venture studios, are specialized firms that support startups and entrepreneurs in launching new companies by developing multiple projects simultaneously through structured processes.

Who Are Accelerators Typically Looking For?

Accelerators typically look for startups that have:

- A solid business plan: Accelerators want to see a clear and well-defined business plan that outlines the startup’s goals, objectives, and strategies for growth.

- A minimum viable product (MVP): Having a functional MVP that demonstrates the product or service is often a prerequisite. This shows that the startup has moved beyond the ideation stage and has something tangible to build upon.

- A strong founding team: Accelerators look for startups with a dedicated and complementary founding team capable of executing their vision. The team’s experience, skills, and commitment are critical factors.

- Growth potential: Startups with significant growth potential, whether in terms of revenue, user acquisition, or market impact, are more likely to be selected. Accelerators seek startups that can scale rapidly and achieve substantial milestones.

- A willingness to learn: Accelerators value startups that are open to feedback and eager to learn from industry experts and mentors. This adaptability and willingness to pivot when necessary are crucial for success in the fast-paced accelerator environment.

By understanding these criteria, you can better position your startup to meet the expectations of accelerator programs and increase your chances of acceptance.

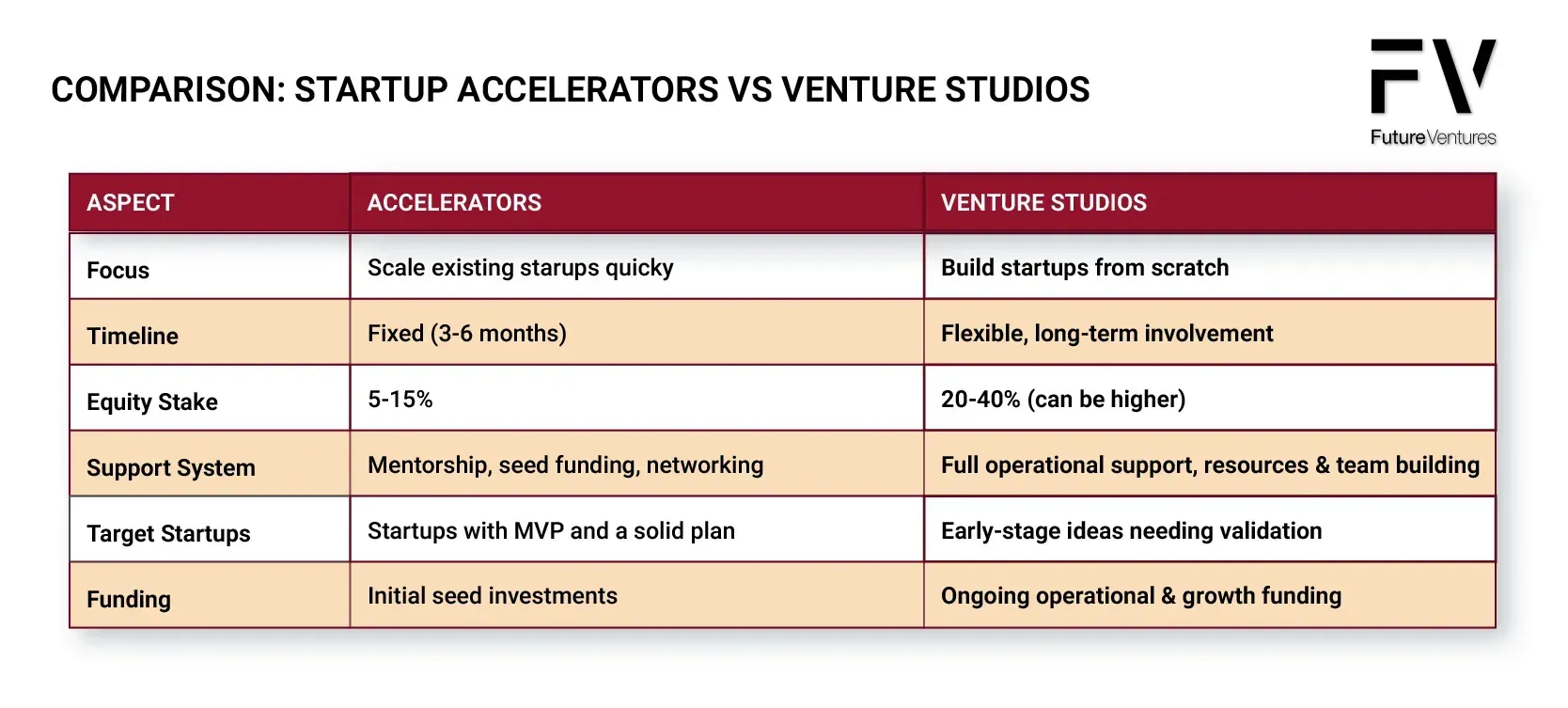

Comparison: Key Differences Between Accelerators and Venture Studios

| Aspect | Accelerators | Venture Studios |

|---|---|---|

| Focus | Scale existing startups quickly | Build startups from scratch |

| Timeline | Fixed (3-6 months) | Flexible, long-term involvement |

| Equity Stake | 5-15% | 20-40% (can be higher) |

| Support System | Mentorship, seed funding, networking | Full operational support, resources & team building |

| Target Startups | Startups with a MVP and a solid plan | Early-stage ideas needing validation |

| Funding | Initial seed investments | Ongoing operational & growth funding |

| Time to Series A | Typically 56 months from founding | 25.2 months from founding |

| Success Rate | Industry standard | 30% higher than traditional startups |

| Average IRR | 21.3% | 53% |

| Approach | Educational and advisory | Hands-on and operational |

| Decision Making | Founder autonomy with guidance | Collaborative with studio involvement |

| Team Building | Minimal support | Active recruitment and development |

Joining a startup incubator also offers essential resources, mentorship, and community support to entrepreneurs at the start of their business journey, providing valuable learning opportunities and access to a supportive network.

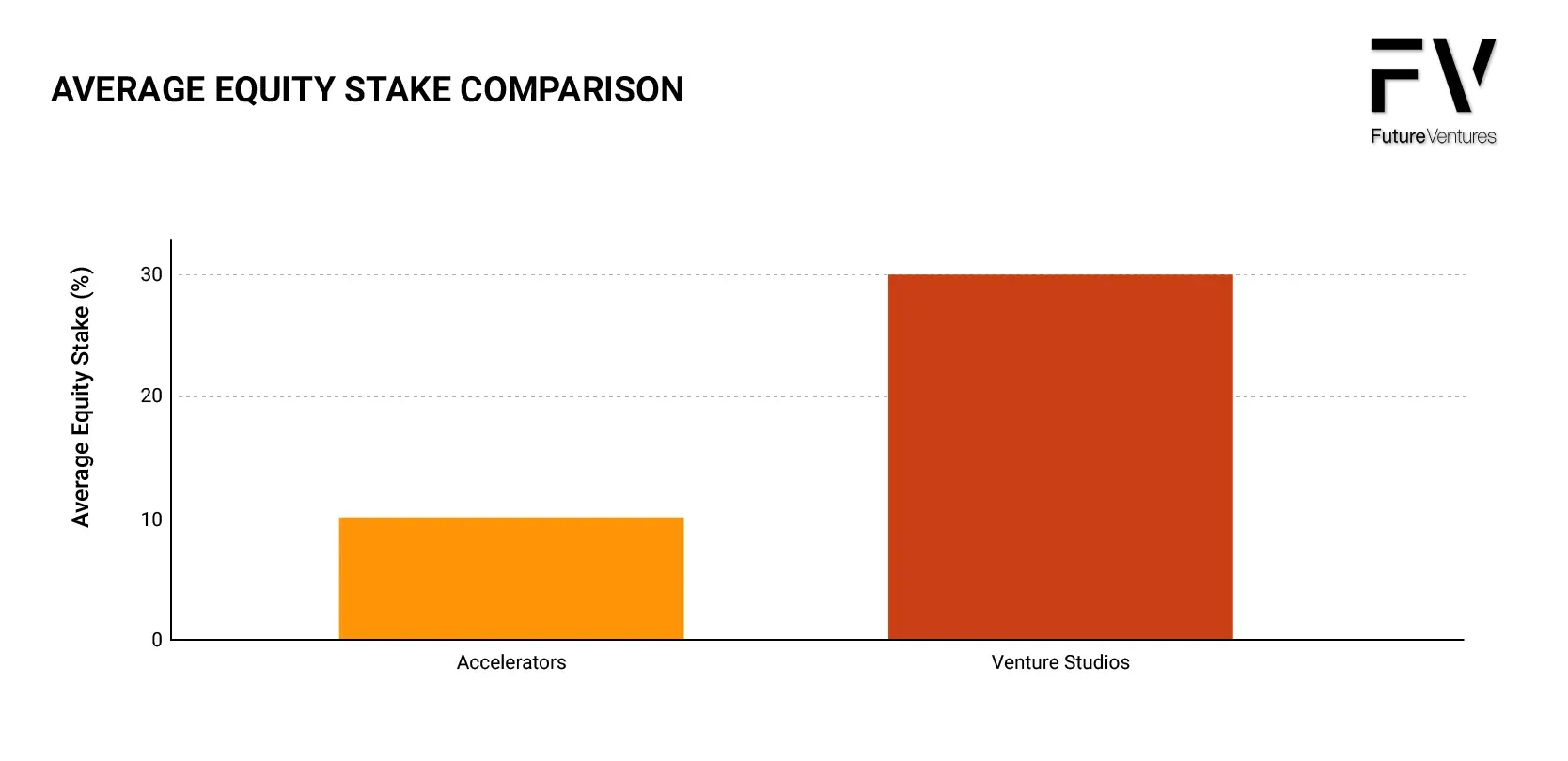

Average Equity Stake Comparison

Understanding these fundamental differences will help you determine which model aligns best with your startup’s needs, your personal working style, and your long-term vision for growth and success.

Venture capital firms play a crucial role in funding startup incubators and company builders, providing capital in exchange for equity to support the development of early-stage companies. Additionally, incubators may help founders build their initial advisory boards, offering strategic guidance and connections that are invaluable during the formative stages of a startup.

Conclusion: Finding the Right Fit for Your Startup

Choosing between a venture studio and an accelerator isn't just about resources—it's about finding a company-building philosophy that fits your vision, skills, and goals. Data shows venture studios have a 30% higher success rate and a 53% IRR compared to 21.3% for accelerators, though they require more equity.

Consider the following:

- Your strengths and needs: Evaluate your team's capabilities. If you excel at execution but need connections, an accelerator might suffice. Venture studios offer extensive resources, including legal and marketing support, which may justify the higher equity.

- Growth timeline: Accelerators focus on rapid, intense growth, while studios provide steady, long-term development.

- Equity vs. support: Weigh the cost of equity against the benefits of faster growth and higher success chances.

- Working style: Decide if you thrive in fast-paced, high-pressure settings (accelerators) or prefer a systematic, methodical approach (studios).

The startup landscape has evolved beyond a one-size-fits-all model. Your best choice aligns with your business needs and personal entrepreneurial style.

Whether you opt for the accelerator's speed or the venture studio's comprehensive support, success