High-Performing Boards: How to Build One That Actually Drives Value

A Comprehensive, Data-Driven, and Provocative Playbook for Scaling Companies

Quick Start: How to Know If Your Board Is High-Performing

If you can’t answer these 10 questions with data, your board isn’t performing; it’s performing theatre.

✅ Do you know your board’s

strategic time allocation (in %)?

✅ Can you quantify

ROI on board initiatives in the past 12 months?

✅ Is there a

formal performance review for directors?

✅ Do board meetings result in

decisions, not discussions?

✅ Does your board composition align with your

3-year strategic priorities?

✅ Are AI, ESG, and digital oversight built into your committees?

✅ Do you have a

crisis protocol and

succession plan tested annually?

✅ Can every director articulate the company’s

value creation thesis?

✅ Is there a

skills matrix and renewal cycle?

✅ Does your board

amplify or

absorb your CEO’s momentum?

If you said “no” to more than 3, your governance is likely stuck in the fiduciary stage.

1. The Truth About Boards - Most Aren’t Performing

Boards love the word oversight until oversight fails.

- Silicon Valley Bank’s collapse wasn’t just a liquidity event. It was a governance failure, characterized by a lack of a dedicated risk committee, blind faith in management’s models and directors without relevant expertise.

- FTX’s implosion? A nonexistent board.

- Credit Suisse? Overconfidence, inertia, and years of red flags ignored.

As highlighted in a recent Harvard Business Review article, these failures underscore the critical importance of effective governance and board practices in preventing such crises.

These weren’t “bad luck” events; they were predictable failures of attention, accountability, and adaptability.

In contrast, the most resilient companies, such as Microsoft post-2014 or Shopify during its rapid scaling phase, treat their boards as performance engines, not compliance clerks, responding to constant pressure from regulators, investors, and the market to maintain high standards and adapt rapidly.

⚡ Key Insight: “A great board doesn’t just protect the business. It projects it into the future.”

2. The Anatomy of a High-Performing Board

Building high-performance boards requires intentional efforts, a commitment to good governance, and a deep understanding of the key elements that drive success, including effective leadership, engaged and involved board members and a strong management team.

High-performing boards excel in making strategic decisions, managing risks, overseeing talent, and driving financial results. They actively engage in strategic discussions, dedicating additional time and resources to their own development and steering the company’s direction.

These high-impact boards focus on developing strategic options, assisting senior teams in stress-testing strategies, and guiding the organization’s trajectory. A hallmark of their success is the ability to reallocate resources effectively and make difficult decisions that serve the organization’s best interests. Compared to lower-performing boards, high-performing boards invest significantly more time in strategy, ensuring alignment with long-term objectives.

The influence of individual directors, the time dedicated to board tasks, and the willingness to serve on boards that value open dissent and high performance all contribute to board effectiveness. Continuous learning for board members is enhanced through ongoing education on key issues, industry trends, and emerging technologies, ensuring they gain a better understanding of the company and industry to support strategy development and remain informed and effective.

Most directors agree that a high-performing board is highly committed to the organization’s mission and values. Highly committed boards invest more effort in strategic oversight, supporting management while maintaining their advisory role.

2.1 Composition: Who’s in the Room Matters

A high-performing board looks less like a country club and more like a strategic SWAT team. The optimal mix includes board members with diverse backgrounds, skills, and perspectives, ensuring that each brings unique value to the table. It is especially important to have board members with experience across different domains, as this diversity enhances strategic oversight and adaptability.

For example, in a small-cap company, having expertise on the board from various industries, such as technology, finance, and consumer goods, enabled the board to identify new market opportunities and mitigate sector-specific risks. These examples illustrate how industry diversity among board members can significantly contribute to enhanced performance and organizational success.

The optimal bo composition mix:

- 30–40% industry experts

- 20% digital/tech/data specialists

- 20% financial and risk professionals

- 10% legal and regulatory experts

- 10–20% futurists or ecosystem builders

Quantitative benchmarks:

- Average board size: 7–9 members

- Board cost: 0.5–1.5% of EBITDA (public) / 0.2–0.5% (private)

- Average meeting time: 150–180 hours per year per director

| Traditional Board | High-Performing Board |

|---|---|

| Homogeneous experience | Cross-functional insight - this diversity ensures broader perspectives and more innovative problem-solving. |

| Quarterly meetings | Continuous engagement, through ongoing involvement, enables timely decisions and agile responses to challenges. |

| “Old guard” directors | Active operators - directors with current operational experience bring practical insights and hands-on expertise. |

| Financial oversight focus | A value creation focus, emphasizing growth and innovation, drives long-term organizational success. |

| Static composition | Dynamic renewal cycle - ensures that the composition remains fresh and relevant, preventing stagnation and promoting a culture of continuous improvement, which enables the board to add sustained value over time. |

| Reactive decision-making | Proactive strategic planning - anticipates future trends, positions the company ahead of competitors. |

| Limited diversity | Emphasis on diverse perspectives - encourages varied viewpoints, enhances decision quality, and reduces groupthink. |

| Informal committee structure | Specialized, purpose-driven committees - focused committees improve oversight and governance effectiveness. |

| Minimal director preparation | Rigorous pre-meeting preparation - well-prepared directors contribute more effectively to discussions and decisions. |

| Low tolerance for dissent | Open dissent and debate foster critical thinking and lead to stronger, more resilient decisions. |

| Focus on compliance | Focus on innovation and growth - prioritizing innovation ensures the company adapts and thrives in changing markets. |

| Siloed communication | Transparent and collaborative communication - open communication builds trust and aligns stakeholders. |

| Short-term focus | Long-term vision and sustainability - planning for the future secures enduring organizational health and success. |

| Risk avoidance mindset | Balanced risk appetite - taking calculated risks enables growth while effectively managing potential downsides. |

Small-Cap Example:

A $100M Canadian manufacturer rebuilt its board from a mix of six retired executives to one that includes finance, operations, and sustainability experts. Within 18 months, EBITDA margins rose by 3%, not because of new machines, but rather to better capital allocation discipline driven by the board.

2.2 Dynamics: How the Room Works

Boards don’t fail because of the wrong people. They fail because of the wrong conversations. In addition to structural issues, other factors such as communication, mutual respect, trust, and candour significantly influence board effectiveness.

High-performing boards cultivate productive tension: the space between challenge and trust. For example, a board may experience open dissent during a strategic planning session, where individual directors respectfully challenge each other's assumptions, leading to more robust decisions. They also foster collaboration between executives and board members, creating a dynamic environment where diverse perspectives contribute to better decision-making and strategic alignment.

Open dissent and communication are essential for building a high-performing board, as they allow for the free exchange of ideas and opinions. They recognize the value of dissenting views and encourage all directors to speak openly and honestly. The role of individual directors is critical in shaping board culture, as their willingness to engage, challenge and support one another directly impacts board dynamics and overall performance.

The board chair plays a crucial role in fostering a culture of open communication and mutual respect, ensuring that all directors feel comfortable sharing their views and perspectives.

Regular feedback and evaluation are also crucial for ensuring that the board operates effectively and that all directors are engaged and committed to their roles. High-performing boards consistently allocate time to governance and performance management discussions, cultivating a culture of accountability and continuous improvement.

The Board Performance Flywheel:

| Stage | Action | Outcome |

|---|---|---|

| Trust | Psychological safety | Candor |

| Candor | Dissent allowed | Insight |

| Insight | Data + perspective | Decision |

| Decision | Clear ownership | Action |

| Impact | Visible results | Learning |

| Feedback | Measured + shared | Renewal |

⚡ Key Insight: When trust drops, the flywheel reverses: decisions slow, insight fades, and groupthink creeps in.

2.3 Committee Architecture: How Governance Scales

As companies grow, committees multiply value by specializing attention.

| Stage | Recommended Committees | Focus Areas |

|---|---|---|

| Startup (< $50M) | Audit / Comp | Financial controls, early governance |

| Scaleup ($50M–$250M) | Audit / Comp / Risk / Nominating | Strategic alignment, leadership pipeline, talent management |

| Mature (> $250M) | Add ESG / Tech / Transformation | Sustainability, digital oversight, future readiness |

Committees are responsible for a range of tasks that support effective governance, such as overseeing financial reporting, risk management, and talent management initiatives. By focusing on these tasks, committees help ensure alignment with organizational strategy and enhance board effectiveness.

⚡ Emerging Trend: The “AI & Tech Governance Committee”, charged with overseeing algorithmic risk, data ethics, and cybersecurity, is now appearing in 20% of North American mid-market boards (up from 6% in 2020).

2.4 Role of Board Members

Board members are the backbone of high-performance boards, shaping the company’s direction through strategic guidance, oversight, and leadership. Their primary responsibility is to challenge and support the management team, ensuring that every major decision aligns with the company’s mission and long-term vision. Effective board members don’t just show up; they arrive prepared, informed and ready to engage.

What sets high-performing boards apart is the calibre and commitment of their members. These directors bring a diverse mix of skills and experiences, from financial acumen to risk management expertise, and are unafraid to ask tough questions or challenge the status quo. They are proactive in identifying opportunities and threats, and they continuously seek out new knowledge: whether it’s emerging technologies, regulatory shifts, or industry best practices.

High performance is not about rubber-stamping management’s plans. It’s about being curious, analytical, and dedicated to the company’s success. By actively participating in board meetings, staying current on industry trends, and investing in their own professional development, these members help drive financial performance, strengthen risk management, and ensure the board delivers real value. Not just oversight.

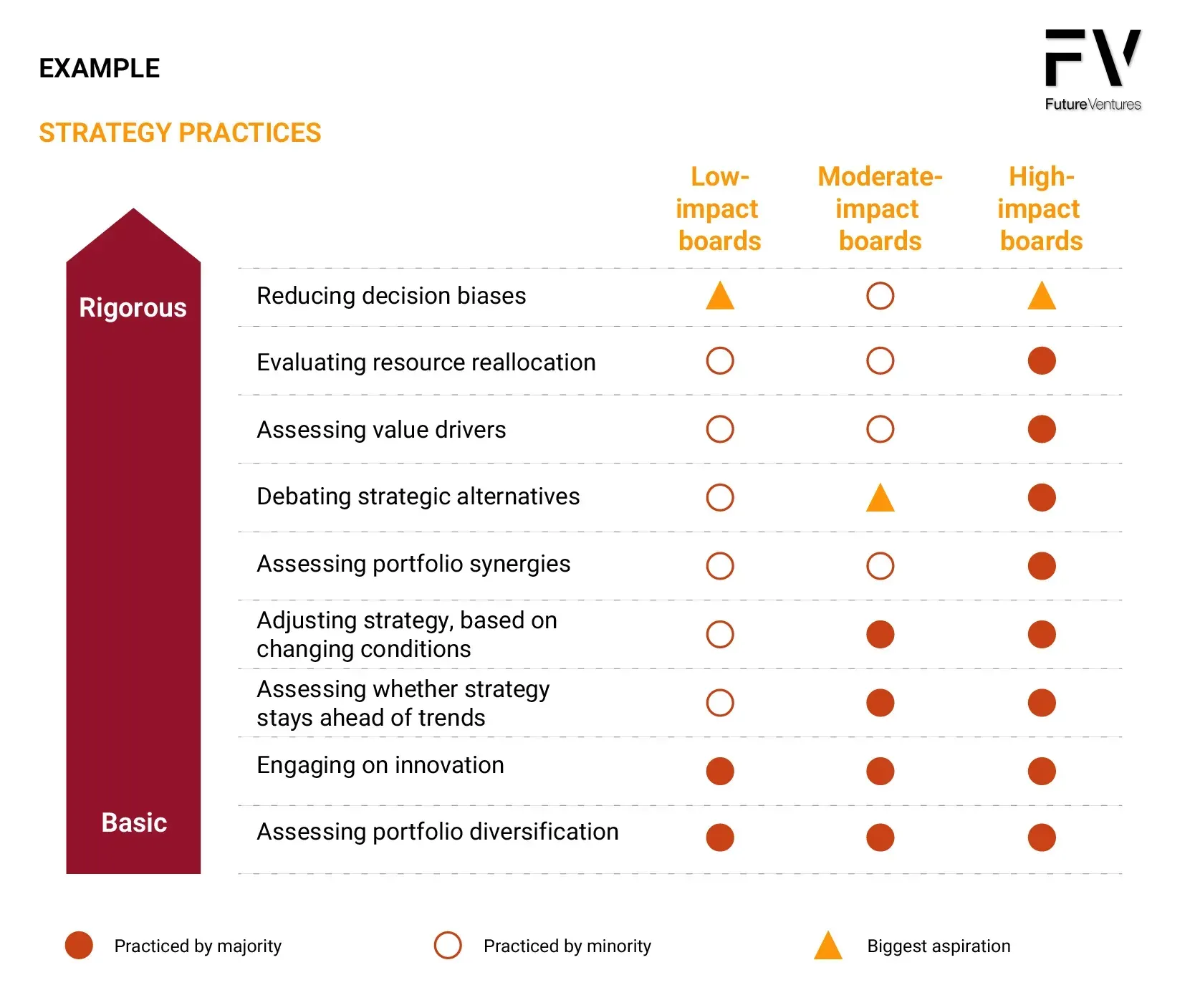

2.5 Hierarchy of Practices

According to McKinsey research, the key difference between higher- and lower-impact boards lies in the range of issues they address and the time they invest in addressing them. Boards progress through a hierarchy of practices similar to Maslow’s hierarchy of needs: lower-impact boards handle basic compliance and financial reviews, while higher-impact boards engage in forward-looking strategy, value analysis, resource allocation and even self-assessment to reduce decision biases.

Boards appear to progress through a hierarchy of practices, with high-impact boards often employing more rigorous practices.

2.6 Management Team Collaboration

The relationship between board members and management is vital for a company’s success. Effective boards foster collaboration through respect, trust and open communication. The chair plays a crucial role in establishing a positive tone and aligning the team with strategic objectives.

Good collaboration involves regular interactions: ongoing conversations where the board guides, questions, and helps solve challenges. The board must also hold management accountable for achieving results and executing strategy effectively.

⚡ Key Insight: "Effective collaboration between boards and management enables organizations to leverage diverse perspectives, enabling them to respond quickly to opportunities and risks."

3. Case Study: From Chaos to Clarity - The $50M Scaleup Turnaround

Company: Western Canadian robotic fabrication firm, 80 employees, $50M revenue.

Problem: Rapid growth, chaotic governance, founder fatigue.

Diagnosis: No committees, agenda dominated by firefighting, directors unsure of roles.

Intervention:

- Introduced risk, audit, and compensation committees.

- Replaced two legacy directors with a digital strategist and a CFO from a peer firm.

- Implemented AI-enabled board dashboards (metrics, meeting summaries).

- Assigned new tasks to the board, including oversight of strategic initiatives and performance management as part of the governance overhaul.

Results (Year 1):

- The decision cycle time dropped from 12 weeks to 7 weeks.

- Forecast accuracy improved 25%.

- EBITDA +19%.

- Hours spent in meetings reduced by 30%.

- Board members invested extra time in strategic activities, performance management, and new investments during the turnaround.

⚡ Key Insight: Governance didn’t cost them growth. It unlocked it.

4. The CEO–Board Contract and Power Dynamics

The boardroom’s most dangerous force isn’t disagreement; it’s misalignment.

Founders often struggle to let go. Investor directors want liquidity. Independents seek legacy. Without a shared purpose, governance becomes a form of trench warfare. CEOs often face internal factions or 'barons' who protect their own fiefs, making governance even more complex.

| Healthy Boardroom | Toxic Boardroom |

|---|---|

| Transparent metrics | Political triangulation |

| Defined decision rights | Shadow management |

| Growth mindset | Fear of dilution |

| Candid CEO feedback | Passive-aggressive silence |

| Collaborative debate | Closed-door decision making |

| Clear accountability | Blame shifting |

| Open dissent encouraged | Groupthink and conformity |

How to Fix It:

- Define the governance charter: what’s management, what’s oversight.

- Institute quarterly CEO–Chair alignment sessions.

- Rotate committee leadership every 2–3 years.

- Utilize 360° board evaluations, incorporating input from the CEO.

CEOs find that more engaged boards do not threaten management’s strategic prerogatives; instead, they can help test strategy, reallocate resources, and provide valuable support without overstepping boundaries.

When Microsoft’s Satya Nadella took over, he rebuilt trust with his board through radical transparency: pre-reads replaced PowerPoints, metrics replaced narratives. The result? Microsoft’s market cap has increased 10x in a decade.

5. Open Dissent and Communication

Open dissent and transparent communication are hallmarks of high-performance boards. The best boardrooms are not echo chambers. They are arenas for rigorous debate, where board members feel empowered to voice dissenting views and challenge assumptions. This culture of candour is essential for surfacing risks, uncovering blind spots, and making well-informed strategic decisions.

The board chair is instrumental in fostering this environment, ensuring that every member’s perspective is heard and respected. By encouraging open dissent, the chair helps prevent groupthink and creates an environment that fosters innovative thinking. Effective communication goes beyond speaking up; it requires active listening, thoughtful questioning, and a willingness to consider alternative viewpoints.

Companies with engaged boards that foster open dissent are better equipped to navigate uncertainty and seize new opportunities. By making robust communication a core part of their culture, these boards drive higher performance, mitigate risks, and make decisions that are truly in the best interest of the organization.

6. Risk Management Strategies

Risk management is a critical function of the board, and high-performing boards take a proactive and strategic approach to identifying, assessing and mitigating risks.

They ensure the organization has a robust risk management process in place, regularly reviewing and updating it to maintain its effectiveness and relevance. They not only focus on what Could Go Wrong (WCGW) but also on What Must Go Right (WMGR). They focus on risks to the strategy and risks from the strategy.

High-impact boards engage more deeply with performance metrics compared to lower-impact boards, utilizing data-driven insights to inform their decisions and ensure the organization’s long-term success.

7. Crisis and Controversy Management

Great boards are measured by their worst day, not their best quarter.

Crisis Playbook Essentials:

| Scenario | First 24 Hours | Board Role |

|---|---|---|

| Cyberattack | Activate incident response, notify regulators | Oversight, not command |

| CEO Scandal | Convene an emergency meeting, appoint an interim | Protect integrity |

| Whistleblower | Engage external counsel | Ensure transparency |

| Activist investor | Build a communication strategy | Unite leadership |

| Product recall | Assess impact, coordinate public response | Crisis management |

| Regulatory breach | Notify authorities, initiate internal review | Compliance oversight |

| Executive departure | Communicate promptly, initiate succession plan | Ensure continuity |

| Financial fraud | Launch a forensic audit and inform the audit committee | Safeguard assets |

| Natural disaster | Evaluate operational risks, support affected teams | Risk oversight |

| Market disruption | Analyze impact, adjust strategy accordingly | Strategic guidance |

⚡ Key Insight: Boards that rehearse crises recover faster. Harvard data shows companies with pre-tested crisis playbooks suffer 35% less market value loss post-crisis.

8. Sector-Specific Governance Realities

Tech/SaaS:

- Speed vs. control dilemma.

- AI/Tech committees are critical.

- KPI focus: ARR, churn, burn rate.

Healthcare/Biotech:

- Regulatory literacy is essential.

- Ethical review boards integrated.

- Time-to-market oversight is critical.

Financial Services:

- Risk committees are non-negotiable.

- Compliance and capital adequacy monitoring.

Manufacturing/Industrial:

- Supply chain resilience oversight.

- Sustainability and operational efficiency focus.

Each sector demands a different governance metabolism. You must tune your board’s cadence to the industry’s volatility. Different industries require tailored governance approaches, as the challenges and priorities can vary significantly across sectors.

9. Evaluation and Renewal 2.0

A high-performing board is never “set”. It’s continuously engineered.

Cultural change within boards is essential for achieving high performance, as it enables adaptability and fosters an environment that encourages innovation and strategic thinking. Numerous authoritative articles provide frameworks and best practices for board evaluation and renewal, supporting the development of effective governance.

9.1 Board Maturity Rubric:

| Level | Description | Evidence |

|---|---|---|

| 1. Foundational | Reactive, compliance-driven | No KPIs or feedback loops |

| 2. Evolving | Strategy occasionally discussed | Ad-hoc reviews |

| 3. Strategic | Regular impact tracking | Aligned dashboards |

| 4. Transformational | Predictive, data-driven, agile | Continuous evaluation |

9.2 Director Peer Review Scorecard Template:

Use this scorecard to assess individual director performance and contributions. Rate each category on a scale of 1 to 5, where 1 = Needs Improvement and 5 = Outstanding.

| Category | Rating (1-5) | Comments / Examples |

|---|---|---|

| Contribution to discussion quality | How well does the director add value to board discussions? Are insights relevant and constructive? | |

| Preparation and attendance | Is the director well-prepared and punctual for meetings? Do they review materials in advance? | |

| Insight relevance | Does the director provide timely, insightful, and actionable input aligned with the agenda? | |

| Cultural impact | How does the director influence board culture? Do they foster collaboration, respect, and openness? |

9.3 Board Meeting Effectiveness Scorecard

Evaluate the overall effectiveness of board meetings using these key metrics:

| Metric | Measurement / Target | Note |

|---|---|---|

| % of time spent on strategic vs. operational topics | Aim for majority strategic focus (e.g., 60-80%) | Ensures the board focuses on long-term value creation |

| Number of decisions vs. discussions | Track ratio to promote decisiveness | A higher decision ratio indicates productive meetings |

| Follow-up completion rate | Target 90%+ completion on action items | Measures accountability and execution |

| CEO satisfaction index | Survey the CEO post-meeting for feedback | Reflects the board’s support and alignment with management |

This scorecard framework enables boards and individual directors to identify their strengths and areas for improvement, driving continuous performance enhancement and governance excellence.

10. Legal, Regulatory, and Insurance Intelligence

Jurisdictional Variance:

- Delaware law prioritizes shareholder primacy.

- Canadian and EU boards operate under stakeholder duty, meaning they consider the interests of a broader range of parties, including employees, customers, and the community, in their governance decisions.

Cross-Border Pitfalls:

- Tax residency and fiduciary duties differ. Keep counsel in both jurisdictions.

D&O Insurance Benchmarks:

| Company Size | Typical D&O Limit | Annual Premium Range |

|---|---|---|

| <$50M | $5–10M | $25K–$75K |

| $50–250M | $10–25M | $75K–$200K |

| $250M+ | $25–100M | $200K–$800K |

Ensure coverage includes cyber liability and regulatory defence. Most claims now arise from data breaches and ESG misstatements.

11. Technology and the Digital Boardroom

The boardroom is going digital. Your portal is your cockpit.

11.1 Top Portal Platforms (2025):

| Platform | Strength | Limitation |

|---|---|---|

| Diligent | Enterprise-grade, AI insights | Expensive |

| BoardEffect | Nonprofit/SMB friendly | Limited analytics |

| OnBoard | Strong mobile UX | Lighter compliance tools |

| Notion + AI | Customizable, cost-effective | Manual security setup |

11.2 AI Copilot Use Cases:

- Summarize meeting minutes and risk logs.

- Predict upcoming agenda conflicts.

- Flag anomalies in KPI trends.

- Suggest agenda items from industry benchmarks.

11.3 Cybersecurity Dashboard Must-Haves:

- Incident heatmap

- Breach response time

- Employee training compliance

- Vendor risk score

12. Building the High-Performance Board Roadmap

| Phase | Focus | Timeframe | Output |

|---|---|---|---|

| 3 Months (Q1) | Diagnose composition, culture, and cadence | Baseline report | Board Health Snapshot |

| 6 Months (Q2) | Align governance charter and committees | Implementation plan | Role clarity + accountability |

| 9 Months (Q3) | Launch dashboards + evaluation loops | Active tracking | Governance KPIs |

| 12 Months (Q4) | Conduct first annual board evaluation | Review findings | Improvement roadmap |

| 15 Months (Q5) | Refine strategic priorities and risk oversight | Strategy update | Enhanced risk management |

| 18 Months (Q6) | Strengthen board development and education | Ongoing training | Increased director effectiveness |

| 21 Months (Q7) | Assess committee performance and board dynamics | Mid-term review | Committee optimization |

| 24 Months (Q8) | Full board performance review and renewal planning | Comprehensive report | Roadmap for next cycle |

Cost–Benefit Illustration:

A typical governance overhaul for a $50 million company costs $150,000–$ 300,000 in consulting, tools, and onboarding. Yet yields an average 4–6x ROI in enterprise value uplift (through faster decisions, better capital allocation, and crisis prevention).

13. The Future of Boards: 2030 and Beyond

By 2030, AI-augmented governance will be standard:

- Predictive audit tools that flag risk in real-time.

- Virtual board assistants summarizing meetings.

- ESG data will be integrated directly into financial reports.

- Autonomous committees simulating decisions before human approval.

The human role will shift from information consumption to judgment orchestration.

⚡ Key Insight: Tomorrow’s directors will need to think like systems engineers, balancing human ethics with machine logic.

14. Tools & Templates

Downloadable Resources (referenced in guide):

- Board Skills Matrix Template

- Director Peer Review Form

- Meeting Effectiveness Scorecard

- Board Maturity Assessment

- Crisis Response Checklist

- Committee Interdependence Map

Final Thoughts

The foundation of high-performance boards lies in the dynamic partnership between board members and the management team. Success is built on a culture of mutual respect, open communication and shared commitment to the company’s mission.

Board members provide the strategic guidance, oversight and leadership necessary to steer the company, while the management team executes on strategy and delivers results.

Building high-performance boards requires a focus on key elements: diversity of skills and perspectives, clear accountability, and a relentless commitment to continuous learning and improvement. When these factors are in place, companies benefit from stronger financial performance, more effective risk management, and a culture that drives innovation and long-term success.

Ultimately, it’s not just about governance. It’s about leadership, collaboration, and the collective pursuit of excellence. By investing in the right people, processes, and culture, organizations can build boards that not only perform but also truly transform the business.

Closing Provocation

If your board were to disappear tomorrow, how long would it take for anyone to notice?

Boards that merely protect value are already obsolete.

Boards that create, measure, and multiply value are the future.

Your challenge isn’t to meet compliance. It’s to govern at the speed of relevance.