Timing Your Move for Pre-Seed Funding

Strategic Timing for Pre-Seed Funding with a Visual Timeline

Timing is critical in the early stages of a startup, especially when it comes to raising pre-seed funding. Let's delve into specific factors influencing the timing for seeking pre-seed funding, along with a visualization to aid understanding.

Specific Factors Influencing Timing of a Preseed Raise

- Market Conditions and Trends:

- Industry Growth Phase: Raising funds during a growth phase in your industry can be advantageous as investors are more likely to invest in trending sectors.

- Economic Climate: Consider the broader economic environment. A recessionary period might not be the best time to seek funding due to investor caution.

- Competitive Landscape: If the market is becoming saturated with competitors, quicker funding may be necessary to gain a competitive advantage.

- Maturity of the Business Idea:

- Proof of Concept: Have you developed a minimum viable product (MVP)? Investors are more inclined to fund startups that have moved beyond the idea stage.

- Customer Feedback: Gather initial customer feedback on your MVP. Positive user response can be a strong indicator that it’s time to seek funding.

- Founder Readiness:

- Pitch Preparation: Is your pitch deck refined and compelling? Investors need to see a clear value proposition and business model.

- Financial Forecasts: Prepare realistic financial projections. Investors will scrutinize your understanding of the financial aspects of your business.

- Operational Milestones:

- Team Assembly: Have you built a core team capable of executing your business plan? A competent team increases investor confidence.

- Market Research:

Complete thorough market research to demonstrate your understanding of the market size, customer needs, and competition.

Optimal Timing for Pre-Seed Funding

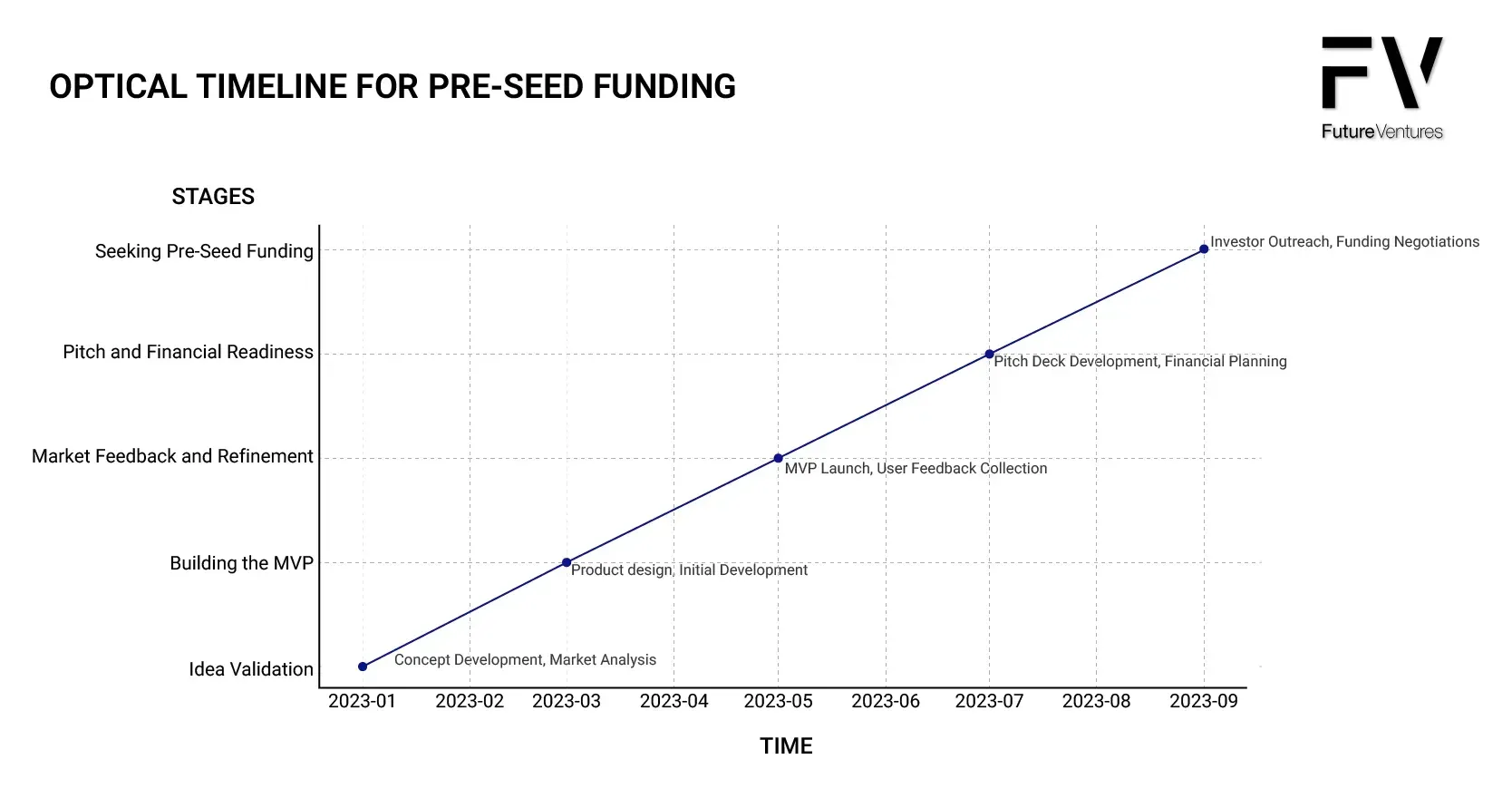

Building a timeline graph showing the optimal progression towards pre-seed funding, highlighting key milestones and decision points, should incorporate the following elements:

- Idea Validation:

- Concept Development

- Market Analysis

- Building the MVP:

- Product Design

- Initial Development

- Market Feedback and Refinement:

- MVP Launch

- User Feedback Collection

- Pitch and Financial Readiness:

- Pitch Deck Development

- Financial Planning

- Seeking Pre-Seed Funding:

- Investor Outreach

- Funding Negotiations

The timeline graph below illustrates the sequential steps leading up to the moment when a startup is ideally positioned to seek pre-seed funding. It highlights key milestones and decision points, starting from the initial idea validation to the final stage of investor outreach and funding negotiations. Each stage marks a critical step in the startup's journey, showcasing how founders can strategically align their efforts and prepare for successful pre-seed funding.

Final Thoughts

Can't emphasize enough the importance of methodical progression and readiness at each phase of the startup lifecycle. By following such a structured timeline, founders can better position themselves to attract and secure pre-seed funding effectively.

References

New Paragraph