Understanding Liquidation Preferences: What Founders Need to Know

You’ve just sold your startup for $50 million. You’re already thinking about the vacation home, a Porsche, maybe a charitable foundation with your name on it. Then the lawyers slide a spreadsheet across the table: the liquidation waterfall. You glance at it, and suddenly, you’re not on the beach. You’re back in your shared apartment, wondering how you’re going to make rent.

What is Liquidation Preference?

Liquidation preference is the fine print that determines who gets paid, in what order, and how much when your company is sold, merged, or liquidated. It’s investor insurance. A contractual way for venture capitalists and other preferred shareholders to get their money back before anyone else sees a cent.

Additionally, it prioritizes preferred investors in the event of a company's bankruptcy or shutdown. In these scenarios, common stockholders are last in line to receive any proceeds, after preferred stockholders have been paid back. When a company is sold, liquidation preferences determine the payout order among holders of different share classes, ensuring that preferred stockholders are paid before common stockholders.

Here’s the catch: liquidation preferences can double, triple, or even wipe out what founders and employees take home in an exit. And if you’re not paying attention during negotiations, you can sign away millions without realizing it. Venture capital investors often require that they receive a liquidation preference over other shareholders as a condition for their investment. Common stockholders may receive little or nothing if the liquidation preference absorbs most of the proceeds.

Why it matters for you:

- It’s not just a legal clause - it’s a wealth allocation mechanism.

- It determines whether you’re celebrating or sulking on exit day.

- It influences how investors view your risk profile and deal attractiveness.

- Liquidation preferences operate by prioritizing payments to certain holders, particularly preferred stockholders, over common stockholders.

In summary, understanding liquidation preferences is crucial because investors receive their entitled payouts before any distribution to common stockholders.

Types of Liquidation Preferences

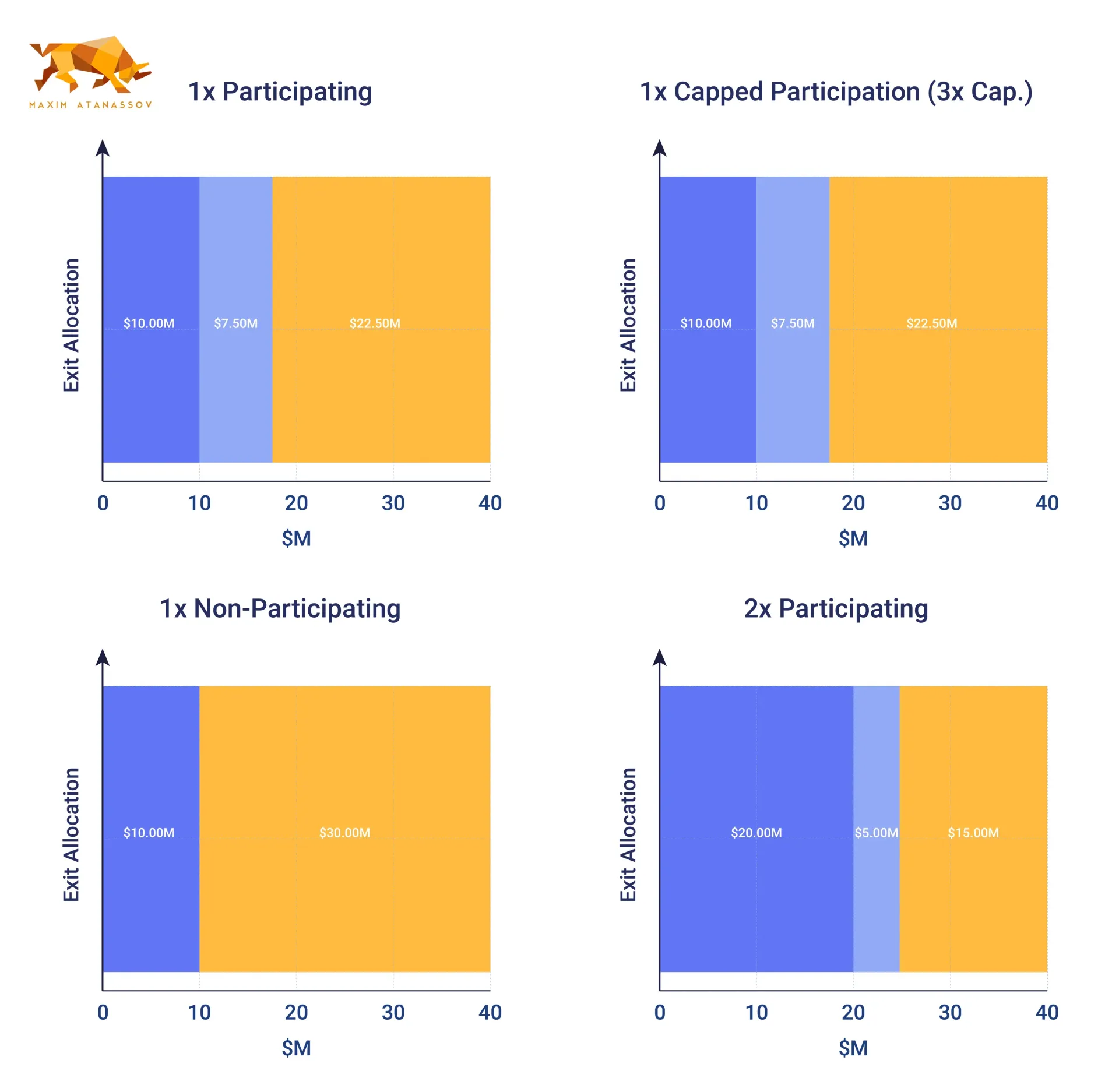

Liquidation preferences come in a few main flavours.

Understanding the difference is like knowing the rules of poker: you don’t want to bet big without knowing the hand you’re holding.

| Type | Investor Gets | Founder Impact | Typical Use Case |

|---|---|---|---|

| Non-Participating (also known as a non-participating liquidation preference) | Full investment amount (or multiple of the original investment price per share) or pro-rata share - whichever is higher. In a non-participating liquidation, investors receive only their full investment amount or a pro-rata share, whichever is higher. | More room for founders/common shareholders if exit is large | Later-stage deals with strong company leverage |

| Participating (participating liquidation preference) | Initial investment plus pro-rata share of remaining proceeds. Participating liquidation preferences allow investors to receive both their initial investment and a share of the remaining proceeds. | Can significantly dilute founder exit proceeds. | Early-stage or investor-favourable deals |

| Capped Participation | Same as participating, but with a limit (e.g., 3x investment) | Protects founders somewhat once the cap is hit. The remaining goes to common shareholders. | Middle-ground compromise |

The preference amount is often a multiple of the original investment price per share, which determines how much investors will receive in a liquidation event.

Story check: A Series A investor puts in $5M for 25% of the company with a 1x participating preference. You sell for $20M:

- The investor first takes back their $5M investment.

- Then takes 25% of the remaining $15M ($3.75M).

- Investor walks away with $8.75M—43.75% of the proceeds despite owning 25% equity.

Liquidation Preference Mechanics

To see how a liquidation preference works in practice, let’s look at a straightforward liquidation preference example.

Imagine a venture capital firm invests $10 million in a startup, receiving preferred stock with a 1x liquidation preference. If the company is later sold for $50 million, the liquidation preference ensures that the venture capital firm recovers its initial $10 million investment first. After this, the remaining $40 million in proceeds is distributed on a pro rata basis between the common shareholders and the preferred shareholders, according to their ownership percentages.

This example highlights how liquidation preference protects investors: they recover their original investment before any other shareholders receive payment. If the company had been sold for less than $10 million, the preferred shareholders would have received all the proceeds, leaving common shareholders with nothing. In higher-value exits, both preferred and common shareholders share in the upside, but the liquidation preference ensures that investors are first in line to recoup their investment.

Understanding this mechanism is crucial for founders, as it directly affects the amount each party receives when the company is sold or liquidated.

Preference Amount and Preference Stack

The preference amount is the specific sum that preferred shareholders are entitled to receive before any other shareholders during a liquidation event. This amount is typically based on the original investment, sometimes multiplied by a liquidation preference multiple (such as 1x or 2x). The preference stack, also known as the seniority structure or liquidation preference stack, determines the order in which different classes of preferred stock are paid out in a liquidation event.

For example, suppose a company has Series A and Series B preferred stock. In that case, the liquidation preference stack will specify whether Series B preferred shareholders receive payment before Series A, or if both are paid on a pari passu (equal) basis. The preference stack can have a significant impact on how much each group of investors receives, especially if the company is sold for less than the total invested capital.

Founders and investors need to understand their position in the preference stack, as it dictates the payout order and can impact negotiations in future funding rounds. Knowing the preference amount and the structure of the stack helps all parties involved anticipate their potential returns in a liquidation event.

Exit Proceeds and Returns

The liquidation preference terms directly shape your exit proceeds. Think of it as the silent tax on your exit valuation. Liquidation preferences have a significant impact on the return on investment and the overall value of a startup.

Participating Preference Effect

- Lower exit? Investor protection kicks in. Founders get crumbs. All the spoils go to the investors holding the liquidation preferences.

- High exit? Investors still take their preference and share, which drags the founder's share.

Non-Participating Effect

- If the exit is big, founders benefit more. Investors choose the better of preference or equity percentage.

- If the exit is small, the investor still gets their money back first.

Example Table: $10M Investment, 25% Equity, 1x Preference

| Exit Value | Participating Investor Take | Non-Participating Investor Tak |

|---|---|---|

| $15M | $10M + 25% of $5M = $11.25M | $10M (preference better than equity) |

| $40M | $10M + 25% of $30M = $17.5M | $10M (equity worth $10M—equal) |

| $100M | $10M + 25% of $90M = $32.5M | $25M (equity worth more than preference) |

Capped Participation and Non-Participating

Capped Participation

A hybrid where investors get preference + participation, but only up to a set limit (e.g., 3x their original investment).

- Good for founders because it sets a ceiling on investor payouts before common shareholders receive the remainder.

Non-Participating

Cleaner for founders in high-value exits since investors don’t double dip. Non-participating preferred stock allows investors to receive either their initial investment amount or a percentage of the proceeds, whichever is higher.

- Often negotiated in later stages when company leverage is higher.

Founder Tip: Push for non-participating in strong fundraising rounds. If you must give participation, cap it.

Long-Term Stock Exchange Considerations

If you’re listing or aiming for long-term investor alignment (e.g., Long-Term Stock Exchange – LTSE principles), liquidation preferences matter because:

- They can signal short-term investor extraction vs. long-term alignment.

- Complex preferences may discourage future mission-aligned investors.

- Public market scrutiny may favour founder-friendly, simple cap tables.

Lesson: Complex preference stacks can be a red flag for future funding rounds.

Liquidation Preference and Investment Agreements

Liquidation preference is a cornerstone of most venture capital investment agreements. These agreements outline the terms under which investors provide capital to a company, and the liquidation preference section is crucial for defining how proceeds will be distributed in the event of a liquidation. Both investors and founders should pay close attention to the details: the preference amount, whether the preferred stock is participating or non-participating, and the structure of the preference stack.

A well-drafted investment agreement will clearly outline the liquidation preference, including any participation rights and the order in which different classes of preferred stock are paid. This clarity helps prevent disputes and ensures that both parties understand their rights and obligations in the event that the company is sold, merged, or liquidated.

For founders, negotiating these terms is essential to protect their own interests and those of common shareholders, while investors rely on the liquidation preference to provide downside protection for their investment. Ultimately, the investment agreement serves as the roadmap for how liquidation proceeds are shared, making it one of the most important documents in any venture capital deal.

Potential Impact on Startup Valuations

The structure of a company’s liquidation preference can have a significant impact on its startup valuation. A high liquidation preference multiple, such as 2x or more, can reduce the potential return for common shareholders, making equity less attractive to employees and founders. This, in turn, can affect the company’s ability to attract and retain top talent, as the perceived value of stock options or common shares may be diminished.

On the other hand, a low liquidation preference multiple may not offer enough downside protection for investors, potentially making the investment less appealing. Striking the right balance is crucial: the liquidation preference multiple should provide sufficient security for investors while still leaving enough upside for founders and employees. Both parties involved in the negotiation must consider how the liquidation preference will impact the distribution of proceeds in a liquidation event, as well as the company’s long-term growth and ability to raise future rounds. Ultimately, the liquidation preference structure can influence not just exit returns, but also the overall health and valuation of the startup.

Negotiating Liquidation Preferences

You don’t need to be a lawyer to negotiate smart. Just understand the leverage points.

Key Levers:

- Multiple – Fight for 1x.

- Participation – Push for non-participating or cap it.

- Stacking Order – Avoid senior stacking; push for pari passu (equal rank).

- Conversion Option – Give investors flexibility to convert to common if it’s better for them—but make sure it’s symmetrical.

Negotiation Matrix:

| Term | Founder-Friendly | Investor-Friendly |

|---|---|---|

| Multiple | 1x | 2x+ |

| Participation | Non-participating | Full participation |

| Stacking | Pari passu | Senior stacking |

| Cap | Yes | No |

Preferred Stock and Liquidation Preference

Liquidation preference lives inside the preferred stock terms. This is the class of shares investors buy that gives them priority payout rights. Common stock represents the basic ownership in a company and is subordinate to preferred stock in liquidation events. Holders of common stock only receive proceeds after all preferred stockholders have been paid according to their liquidation preferences.

Implication for you:

- Every preferred share has different rights. Series A may be pari passu with Series B, or Series B may be senior (getting paid first).

- Stacked seniority can mean early investors leapfrog later ones (or vice versa).

Rule of Thumb: Simplify your preference stack early to avoid death by a thousand clauses later.

Cumulative Preferred Stock

Some preferred shares come with cumulative dividends: meaning unpaid dividends pile up over time and get paid before common shareholders see a penny in a liquidation.

Why it matters:

- Can add millions to investor payouts if exit happens years later.

- Creates hidden liabilities on your books.

Founder Strategy: Avoid cumulative if possible; opt for non-cumulative to keep payouts lean.

Convertible Preferred Stock

Convertible preferred gives investors the right to switch to common shares if it’s better for them.

- Upside: Investors share the upside if the company grows.

- Downside: Can dilute founder take-home if conversion happens in a big exit.

Conversion Ratio – Defines how many common shares each preferred share converts into.

Example: 1:1 ratio means each preferred becomes one common. If your valuation skyrockets, investors will likely convert to ride the upside rather than take their preference.

Putting It All Together: Founder’s Survival Framework

Here’s your Founder’s Liquidation Preference Playbook. Print it. Stick it on your monitor. Live by it:

- Know Your Waterfall – Run payout scenarios at different exit values before signing.

- Fight the Multiple – 1x is standard; anything higher is a red flag.

- Cap the Participation – Or remove it entirely.

- Watch the Stack – Push for pari passu over seniority.

- Avoid Cumulative Dividends – They’re silent killers.

- Keep Conversion Ratios Fair – Prevent over-dilution.

The Bottom Line

Liquidation preferences are not just investor fine print—they’re the rules of the payout game. Get them wrong, and you can turn a life-changing exit into a cautionary tale whispered in founder circles.

"The most dangerous part of a negotiation isn’t what’s in the contract. It’s what you don’t understand in the contract.”

Additional Resources

If you want to delve deeper into the world of liquidation preference and its role in venture capital investment agreements, several trusted resources are available.

- The National Venture Capital Association (NVCA) provides comprehensive guides and model documents that explain key terms, such as liquidation preference and preference stack.

- The Securities and Exchange Commission (SEC) provides regulatory information and educational materials on investment structures and shareholder rights.

- For ongoing analysis and industry trends, publications such as Venture Capital Journal and PitchBook regularly cover how liquidation preference terms are evolving and their impact on startup valuations.

These resources are invaluable for both investors and founders looking to understand better how liquidation preference works, how to negotiate favourable terms, and how these clauses can shape the outcome of an investment or exit event. By staying informed, you can make smarter decisions and protect your interests in any investment agreement.