Pre-Seed vs. Seed: The Key Differences Every Startup Founder Should Know

The startup funding landscape has evolved dramatically, creating more defined stages with clearer expectations at each level. For founders navigating this terrain, understanding the critical distinctions between pre-seed and seed funding isn't just academic—it's existential. The difference between these two early funding rounds can mean the difference between launching effectively and wandering in the wilderness of undercapitalization.

Pre-seed is about validating your concept and building your MVP, while seed funding propels you toward market validation and scaling. This guide breaks down these crucial first funding stages with precision and clarity, providing founders with actionable insights to secure the right funding at the right time.

Comparison: Pre-Seed vs Seed Funding

| Criteria | Pre-Seed | Seed |

|---|---|---|

| Stage Definition | Idea/MVP Development | Market Validation & Scaling |

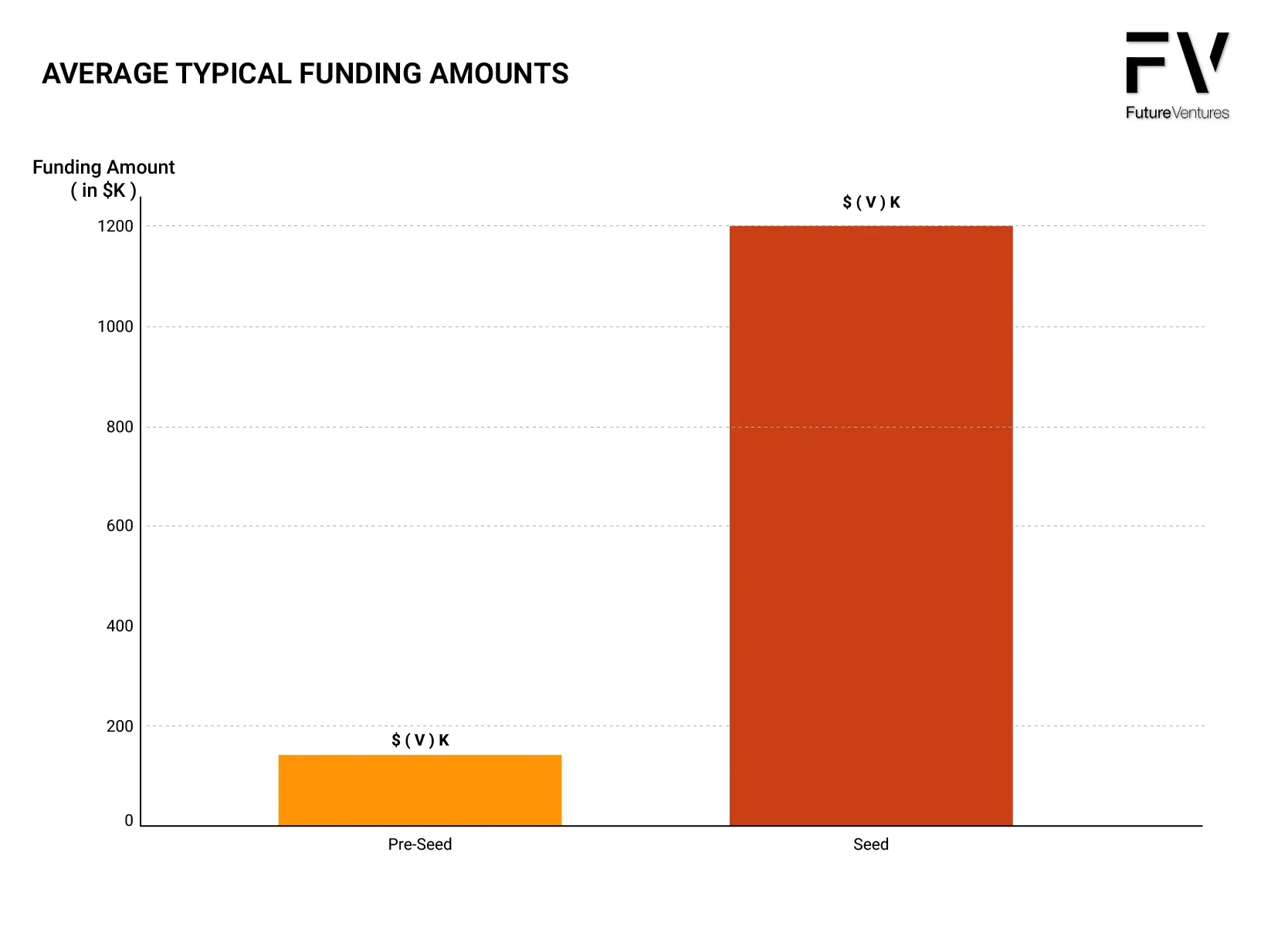

| Typical Funding | 50K - 250K | 500K - 2M+ |

| Product Maturity | Prototype / MVP | Live Product with Traction |

| Investor Type | Friends, Family, Angels | Angel & VC |

| Risk Level | Very High | High |

| Valuation | 1M - 3M | 5M - 15M |

| Use of Funds | Concept Validation, MVP, Team | Scaling, Product Refinement |

The Evolving Startup Funding Ecosystem

The startup funding landscape has become increasingly stratified, with pre-seed emerging as a distinct phase from what was traditionally lumped into "seed" funding. In some cases, the 3F (Friends, Family and Fools) has emerged as a distinct phase preceding the pre-seed round. This evolution reflects the growing sophistication of early-stage investment and higher expectations at each funding milestone.

Many pre-seed investors look for signs of bootstrap traction, which isn't limited to revenue; it can also manifest as a minimum viable product (MVP). This statement captures the essential shift: investors now have specific expectations even at the earliest funding stages.

Understanding Funding Stages

Understanding the different funding stages is crucial for startup founders to navigate the fundraising process. Each stage of funding serves a specific purpose and is designed to help startups progress to the next level of growth. As startups evolve, they require different amounts of capital and resources, making it important for founders to be well-versed in the nuances of each funding stage.

Pre-seed and seed funding are two of the earliest stages of funding, and it’s essential to know the key differences between them.

- Pre-seed funding is often the first external capital that a startup receives, laying the groundwork for future development and growth.

- Seed funding, on the other hand, helps startups to build momentum by providing additional resources needed to refine their product and expand their market presence.

Each funding stage has its unique characteristics, and founders should be aware of these differences to make informed decisions. For example, pre-seed funding might focus more on validating a business idea and developing an initial product, while seed funding could be aimed at scaling operations and increasing market traction. By understanding these distinctions, founders can better align their strategies with investor expectations, increasing the likelihood of securing the necessary capital for their startup's success. The key difference between pre-seed and seed funding is market traction; pre-seed companies are typically unproven.

Pre-Seed Funding: Planting the Idea

Definition and Purpose

Pre-seed funding is one of the earliest stages of funding, often following the "friends and family" or also known as the 3F or Three F round, standing for Friends, Family and Fools. The 3F relies heavily on those closest to the founder who believe in the vision before tangible results exist. While the friends and family round is typically the very first source of external capital for a startup, pre-seed funding serves as a more structured financial boost to help transition from a mere idea to a tangible product or service. Pre-seed funding represents the earliest, external to 3F, capital infusion for startups, typically occurring during ideation and initial development phases.

The primary goal of pre-seed funding is to transform ideas into tangible prototypes. This funding stage is focused on ensuring the solution addresses a real market need. Pre-seed funding is primarily focused on early product development and proving a need in a niche market. Entrepreneurs use pre-seed funding to create a minimum viable product (MVP) and test the market.

This stage is crucial for early product development, market research, and demonstrating a market need. Pre-seed funding often involves a mix of angel investors and early-stage venture capitalists who are willing to take a risk on unproven concepts with high potential.

Characteristics and Expectations

At the pre-seed stage, startups typically lack revenue and sometimes even a functioning product. What they do have is potential—a compelling vision backed by initial research and perhaps a rudimentary prototype. The funding amounts are relatively modest, ranging from $50,000 to $250,000, reflecting the early, high-risk nature of the investment. Companies typically raise between $50K to $250K during pre-seed funding.

Pre-seed investors primarily evaluate three factors:

- The strength of the founding team and their domain expertise.

- The clarity and viability of the concept.

- The potential market opportunity and initial validation efforts.

Most pre-seed founders shouldn't rely on money to start their business; rather, they should use it to enable growth. This captures the core expectation: pre-seed funding shouldn't be about conception but about the acceleration of an already-initiated vision.

Is Pre-Seed the Same as Angel?

No,

pre-seed and angel investment are not the same, though they often overlap:

- Pre-Seed refers to the earliest stage of funding aimed at developing an MVP or validating a business idea. It is typically funded by friends, family, early-stage incubators, or even personal savings.

- Angel Investment involves individual investors (angels) who use their personal wealth to fund startups at various stages, including pre-seed. Angel investors are high-net-worth individuals who invest in early-stage companies. Angels often provide mentorship and networking opportunities alongside capital.

Key distinctions:

- Source of Funds: Pre-seed is often funded by close networks or incubators, while angel investment comes from high-net-worth individuals (Typically, 200,000+ in annual earnings or 1,000,000+ in net worth and regulatory defined in different countries).

- Stage of Startup: Angel investment can occur at both pre-seed and seed stages but is more common when there is some market traction or an MVP in place.

Seed Funding: Cultivating Growth

Definition and Purpose

Seed funding represents the first significant institutional investment round, occurring when a startup has demonstrated initial traction with its product or service. If pre-seed funding is about legitimizing an idea, seed funding is about legitimizing a business.

Seed funding shifts its primary focus from validating a business idea to scaling and expanding into new markets. It provides startups with the necessary resources to refine their products, grow their user base, and lay the groundwork for rapid growth. This stage of funding is crucial for refining the business model, expanding the team, and gaining market traction. Founders utilize seed funding to solidify their business ideas and prepare for future funding rounds. Seed funding focuses on scaling operations and covering operational expenses. Additionally, it is often used for product production, market research, and hiring key team members.

Characteristics and Expectations

By the seed stage, investors seek clear advancements—beyond mere hopeful concepts. Expectations escalate significantly. Investors expect the company to have a market-ready product that consumers are eager to buy. The funding amounts increase accordingly, typically ranging from $200,000 to $2 million or more.

Seed investors focus on:

- Product-market fit (PMF) and evidence of traction.

- A scalable business model with the potential for significant returns.

- A clear path to growth and market expansion.

- A strengthened team with key roles filled.

This stage represents the transition from an experimental venture to a growth-oriented business. The expectation isn't perfection but rather a validation that the business concept works and can scale with additional resources.

Comprehensive Comparison and Key Differences Between Pre-Seed vs. Seed Funding

Detailed Comparison Table

| Criteria | Pre-Seed | Seed |

|---|---|---|

| Stage Definition | Idea, MVP Development and Market Research | Market Validation & Scaling |

| Business Phase | Concept validation | Growth acceleration |

| Typical Funding* (ranges vary based on market and industry) | $50K - $250K | $200K - $2M+ |

| Product Maturity | Prototype / MVP | Live Product with Tractio |

| Investor Type | Friends, Family, Angels | Angel & VC |

| Risk Level | Very High | High |

| Valuation | $1M - $3M | $5M - $15M |

| Use of Funds | Concept Validation, MVP, Team | Scaling, Product Refinement |

| Revenue Expectations | Pre-revenue to minimal | Early recurring revenue |

| Team Size | Founders + core members | Growing team with specialists |

| Market Validation | Hypothesis and initial feedback | Demonstrated customer adoption |

| Runway Created | 12-18 months | 18-24 months |

Key Differentiating Factors

The fundamental distinction between pre-seed and seed funding is the shift from potential to proof.

- Pre-seed backs the idea and the team's ability to execute.

- Seed funding backs demonstrated execution with potential for scale.

The maturity expectations also differ dramatically. For pre-seed, a thoughtful concept with initial validation may suffice. For seed, investors expect "a live product in a market that people are willing to pay for"—a much higher bar requiring significant progress between funding stages.

When to Pursue Pre-Seed vs. Seed Funding

Readiness Indicators for Pre-Seed

You're likely ready for pre-seed funding when:

- You have a well-defined problem and proposed solution.

- You've developed a prototype or are close to an MVP.

- You've conducted initial market research validating the need.

- You need capital to build your core team and refine your product.

- Your valuation expectations align with the $1-3M range. Startups with a valuation of $1M to $3M are typically ready for pre-seed funding.

As one expert explains: "The right time to raise pre-seed funding is a confluence of market readiness, idea maturity, personal preparedness, and financial necessity". This timing requires honest self-assessment of your startup's development stage.

Readiness Indicators for Seed

You're positioned for seed funding when:

- You have a functioning product with users or customers.

- You're showing early traction metrics (user growth, engagement, revenue).

- You've validated product-market fit.

- You need capital to scale operations and accelerate growth.

- Your valuation can reasonably support a $5-15M valuation. Startups valued at $5M to $15M are typically ready for seed funding.

A critical mistake many founders make is pursuing seed funding prematurely. As one venture firm notes, "Pursuing a seed round when you are actually pre-seed can waste six months of your life and create unnecessary anguish."

Strategies for Funding Success

Pre-Seed Stage Approach

At the pre-seed stage, focus on:

- Building and showcasing your MVP: Demonstrate that your solution works, even in its most rudimentary form. Don't depend on money to start your company; rely on it to scale your business. Show, don't tell. Have a working product and early measurable traction.

- Leveraging personal networks: Friends, family, and personal connections are key sources at this stage. Don't underestimate the power of these relationships in securing initial capital. Typically, it involves networking with potential investors and pitching the business idea.

- Demonstrating problem-solution fit: Provide evidence that your solution addresses a real, pressing problem for a defined market segment.

- Focusing on team strength: At this early stage, the quality of the founding team often outweighs other factors. The biggest factor in investors' decisions is always the founding team. There are plenty of good ideas. However, it is the founding team's ability to execute their strategy that consistently determines success. Success hinges on the founders' capacity to make rapid and sound decisions.

- Prep and research: Founders should research and identify potential investors who are interested in their industry and funding stage. Founders should be prepared to answer questions and provide feedback to potential investors.

- Fundraising Duration: The pre-seed funding process can take several months to a year or more.

Seed Stage Approach

For seed funding success

- Demonstrate traction and validation: Show concrete user growth, engagement metrics, or early revenue. Investors expect the company to have a working product that people are willing to pay for.

- Build relationships with institutional investors: Start connecting with seed-focused VCs and established angel investors well before you need the money.

- Develop a compelling scaling narrative: Articulate clearly how additional capital will accelerate growth and market penetration.

- Present a refined business model: Show that you've moved beyond validation to a repeatable, scalable approach to acquiring and monetizing customers. Founders should have a clear and concise pitch deck and business plan. Founders should be prepared to answer questions and provide feedback to potential investors.

- Fundraising Duration: The seed funding process can take several months to a year or more.

Pitch Deck and Business Plan

A pitch deck and business plan are essential tools for securing funding. Founders should create a clear and concise pitch deck that showcases their business idea and market fit. A business plan should outline the company’s goals, milestones, and financial projections. Founders should be prepared to present their pitch deck and business plan to potential investors. As many investors often say, "Always be raising!"

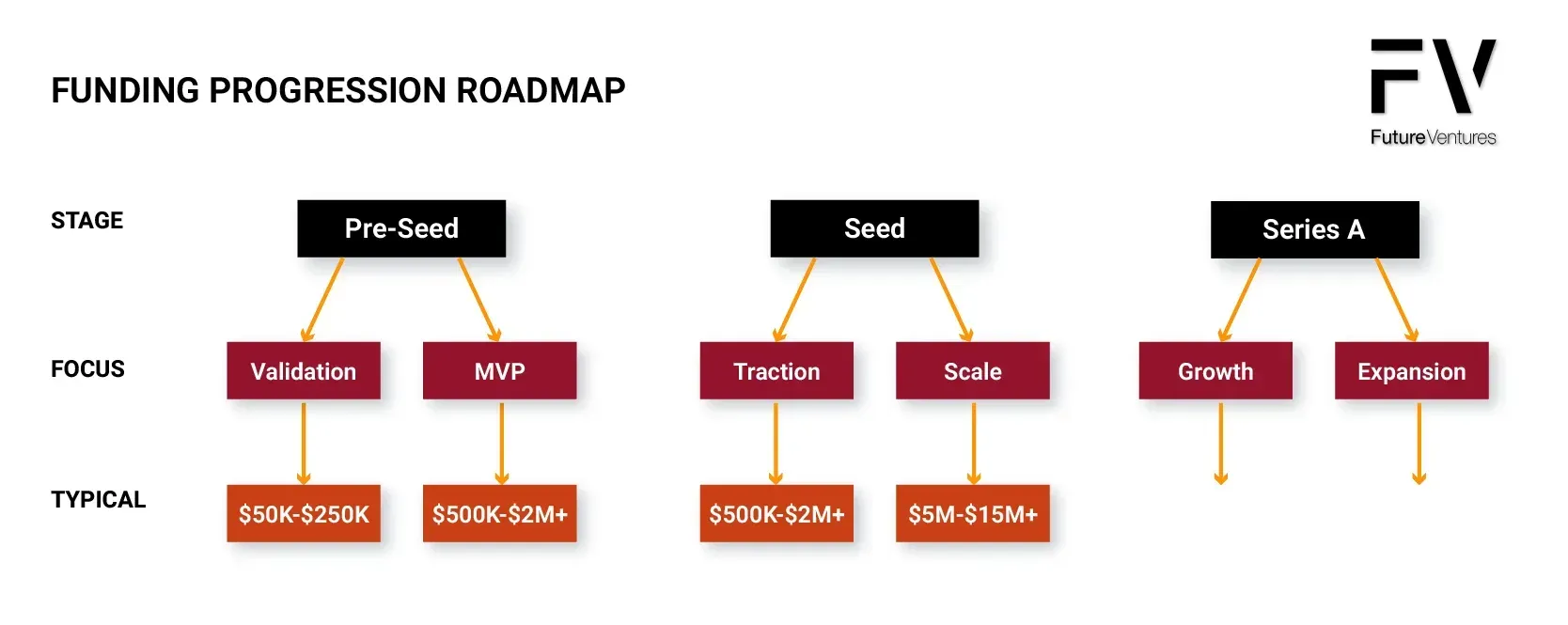

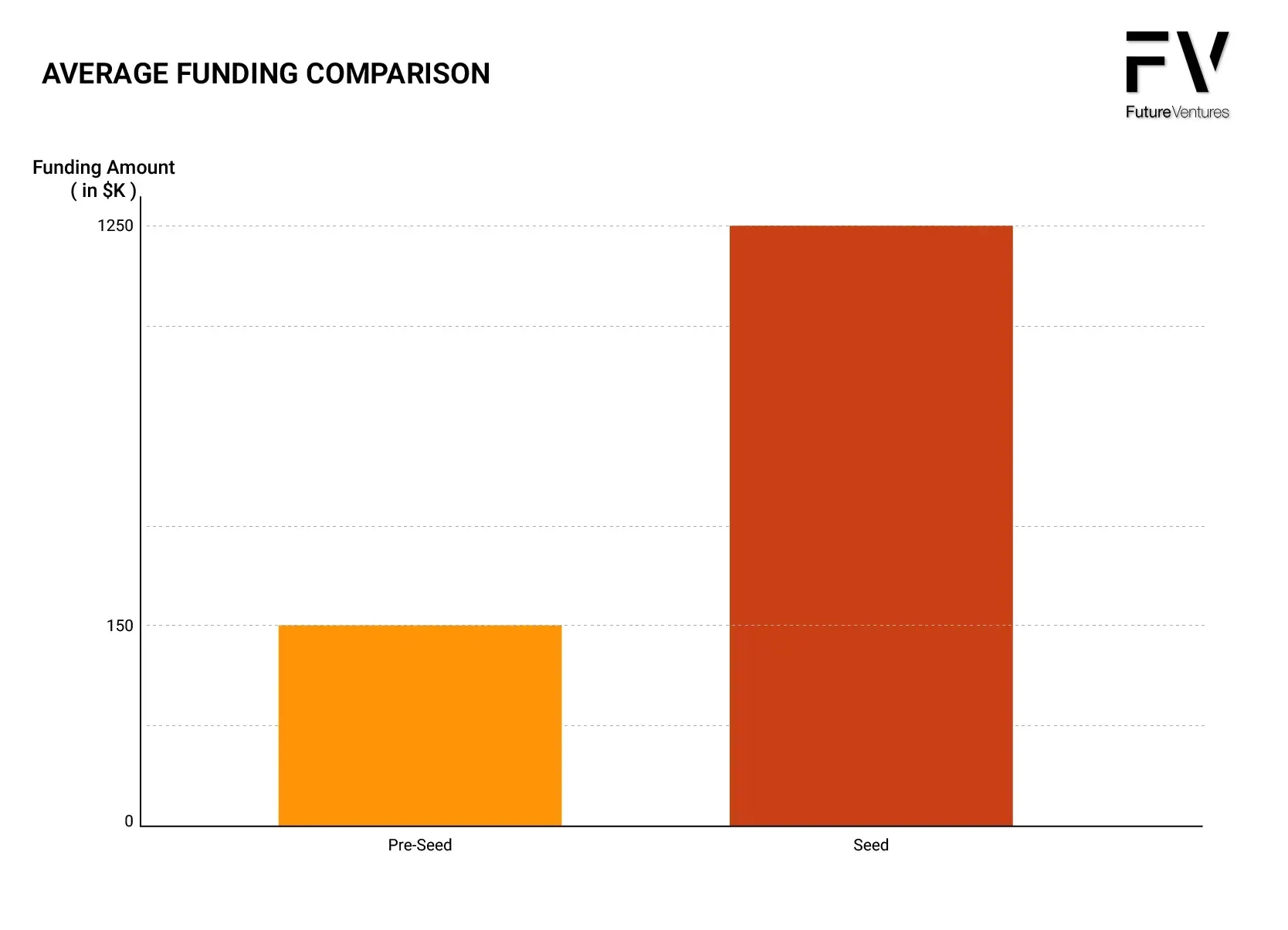

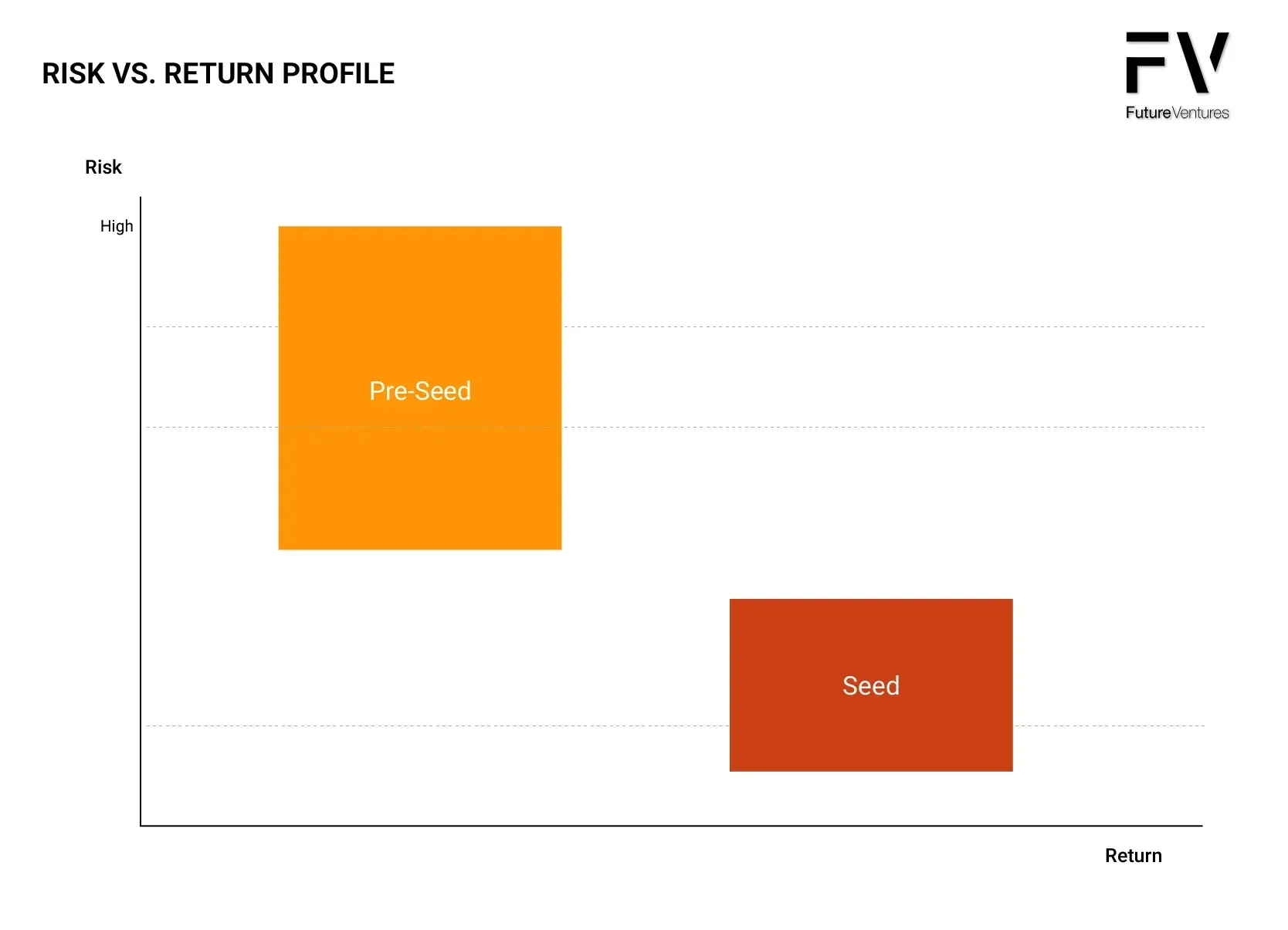

The Funding Journey Visualized

Funding Progression Roadmap

Average Funding Comparison

Risk vs. Return Profile

How Long from Pre-Seed to Seed?

The timeline from pre-seed to seed funding typically spans 6 to 18 months, depending on the startup's progress, industry, and ability to hit key milestones. Pre-seed funding generally provides a runway of 6–18 months, during which startups focus on developing their MVP and validating their concept. Founders are advised to start preparing for seed funding at least 6 months before their pre-seed runway ends to ensure a smooth transition without financial gaps.

What are the Disadvantages of Pre-Seed?

Pre-seed funding comes with several potential drawbacks:

- Early Equity Dilution: Founders often give up a portion of equity at this early stage, which can reduce their ownership and control over the company in later rounds.

- Investor Control: Early investors may exert significant influence over the company's direction, which might not always align with the founders' vision.

- Pressure to Deliver Quickly: Investors expect rapid progress, which can lead to rushed decision-making and increased stress for founders.

- Time-Consuming Process: Raising pre-seed funds can be a lengthy and distracting process, taking focus away from product development and other critical activities.

- Challenges in Future Rounds: Without achieving meaningful traction during the pre-seed stage, startups might struggle to raise subsequent funding rounds.

The leading investors for Pre-seed and Seed funding

Startups seeking pre-seed or seed funding have a variety of choices, including incubators, accelerators, angel investors, family offices, venture capital firms, and crowdfunding platforms.

Founders should research and network with potential investors to find the right fit for their company. Building relationships with investors is crucial for securing funding and getting valuable feedback.

Pre-seed

In the pre-seed stage, founders can most effectively raise capital or expand their businesses by engaging with incubators, utilizing crowdfunding, or presenting their ideas to angel investors. Below are some of the top programs and platforms available for pre-seed startups:

Seed

During the seed stage, startups have opportunities to seek support from crowdfunding, angel investors, and family offices and can begin pitching to venture capitalists (VCs) while applying for accelerator programs. It's important to note that some of the programs and investors mentioned offer options at the pre-seed stage, too, although their main focus is on seed-stage startups.

- 500 Global

- AngelPad

- Y-Combinator

- Tech Stars

- Google for Startups Accelerator

- Sequoia Capital

- Andreessen Horowitz

- Accel Partners

Conclusion: Strategic Timing for Maximum Impact

The distinction between pre-seed and seed funding isn't semantic—it's strategic. Jumping prematurely to seed funding without proper pre-seed development can doom otherwise promising ventures. As one venture capital firm starkly warns, "Only about 10% of the companies we work with have successfully raised a seed round without both an MVP and some demonstrated level of market traction".

The savvy founder understands that each funding stage serves a distinct purpose in the startup's evolution. Pre-seed funding transforms ideas into viable products, while seed funding converts viable products into growing businesses. Matching your funding approach to your actual stage of development isn't just good practice—it's essential for survival.

In the words of Scott Galloway, "Money is a commodity, but the timing and strategy behind it are not". For founders navigating the complex startup ecosystem, this insight might be the difference between building the next unicorn and joining the 90% of startups that fail.

Choose your funding stage wisely, align your expectations with reality, and remember: the goal isn't just to raise money—it's to build a sustainable, growth-oriented business that delivers value to customers and returns to investors.

Author's Bio

Maxim Atanassov is a strategic advisor, transformation leader, and investor with over 20 years of experience scaling businesses across sectors. Based in Calgary, Maxim blends deep financial insight with emerging technologies to unlock growth, manage risk, and build future-ready organizations.

As a serial entrepreneur and tech founder, Maxim has led complex transformations that turn vision into execution—helping companies modernize operations, architect new capabilities, and outperform their industries. His approach fuses AI integration with strategic governance, enabling clients to capitalize on disruption and scale with confidence.

At Future Ventures, Maxim partners with founders, executives, and investors to drive bold change—offering hands-on guidance from idea to impact. Known for his clarity in strategy design and ability to operationalize innovation, he plays a pivotal role in shaping the ventures and ventures-to-be that define tomorrow.